Ghaziabad Property Investment: Your Complete Guide to Achieving ₹1 Lakh Monthly Rental Income in 2025

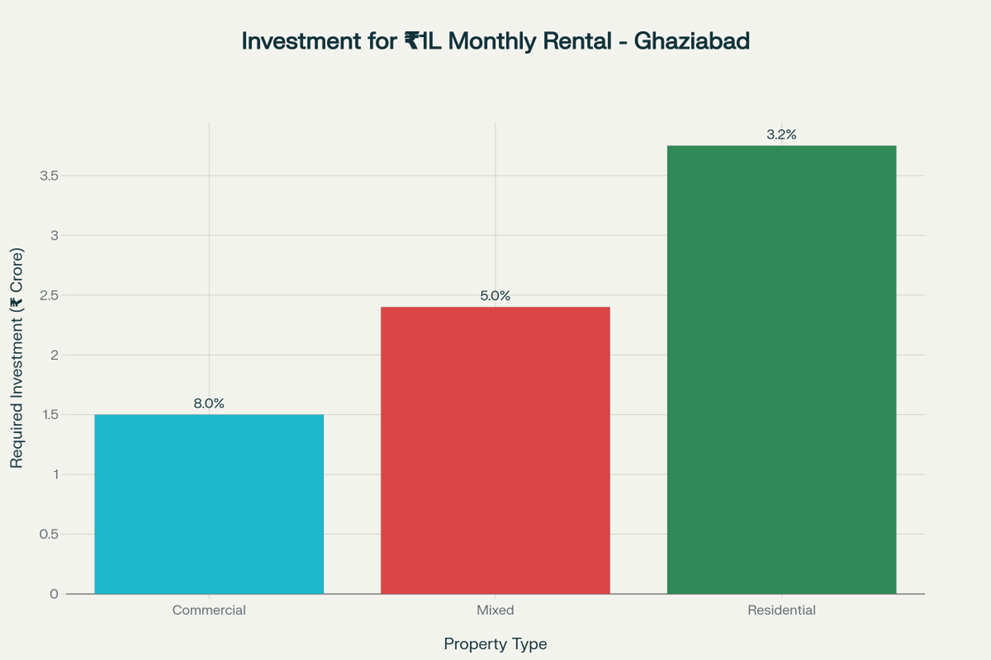

Ghaziabad has emerged as one of the most promising real estate investment destinations in the National Capital Region (NCR), offering investors a strategic blend of affordability, connectivity, and robust rental demand. For investors targeting a specific monthly rental income of ₹1 lakh, Ghaziabad presents multiple pathways through commercial properties, residential investments, and mixed portfolios. With property prices rising by 73% in Indirapuram over the past five years and rental yields ranging from 3.2% to 8% across different property types, the city offers compelling opportunities for both novice and experienced investors. [1][2][3]

Investment Requirements for Rs 1 Lakh Monthly Rental Income in Ghaziabad by Property Type

Market Dynamics and Investment Landscape

Current Market Performance

Ghaziabad’s real estate market has demonstrated remarkable resilience and growth potential. Indirapuram leads the city with the highest transaction volumes, recording between 3,500-4,000 units annually—nearly three times the pre-pandemic average. The area witnessed a 19% price increase in FY 2025 alone, compared to a 9% rise across the broader Ghaziabad market. This growth trajectory is driven by strategic infrastructure developments and proximity to Delhi’s employment hubs. [1]

The average property prices across Ghaziabad currently stand at approximately ₹5,600 per square foot, representing a 72% growth over five years. However, this average masks significant variations across different micro-markets, with premium areas like Indirapuram commanding ₹15,000 per square foot while emerging locations like Crossings Republik offer properties at ₹6,500 per square foot. [3][4][5]

Infrastructure-Led Growth

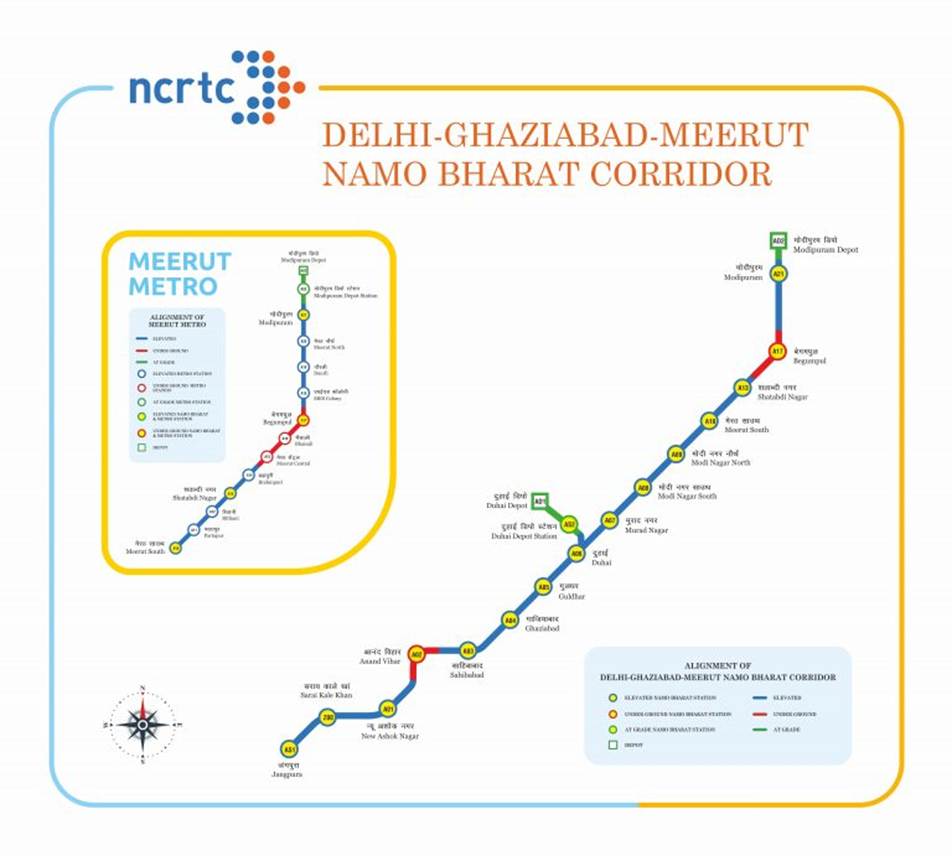

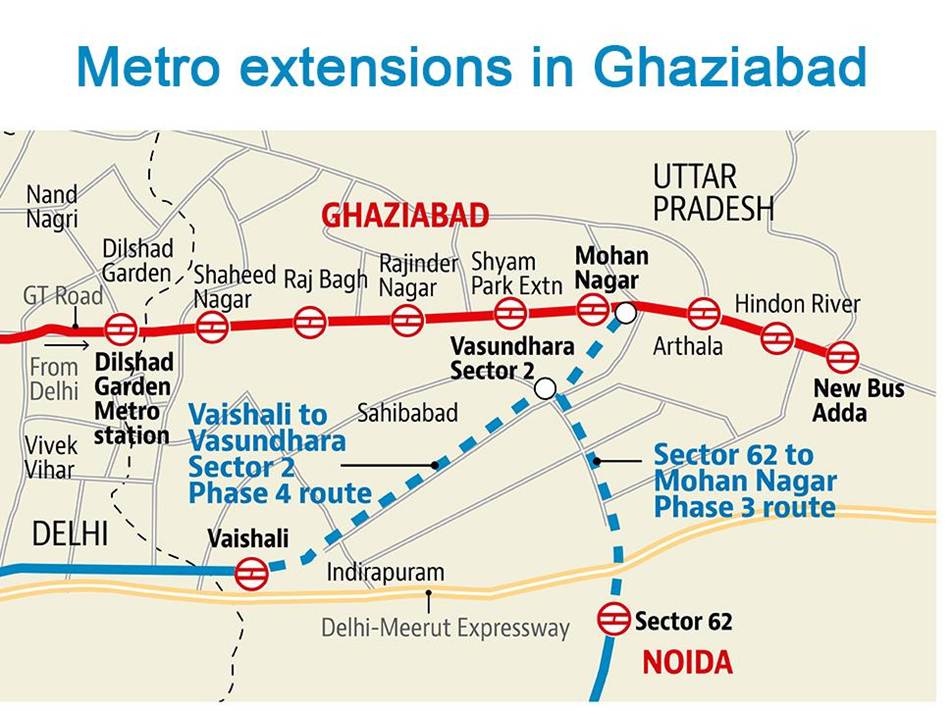

The city’s transformation is anchored by major infrastructure projects that have reshaped its connectivity profile. The Delhi-Meerut Expressway has dramatically reduced commute times to central Delhi, while the Regional Rapid Transit System (RRTS) is expected to further enhance accessibility. The Delhi Metro’s extension through eight stations in Ghaziabad provides seamless connectivity to employment centers in Delhi and Noida.[1][2][6]

Delhi-Ghaziabad-Meerut Namo Bharat Corridor metro route map showing connectivity and station types.

Map highlighting metro extensions connecting Ghaziabad with Delhi and Noida, showcasing rapid transit infrastructure development.

These infrastructure developments have created a ripple effect across the property market, with areas like Wave City and Raj Nagar Extension experiencing significant appreciation potential. The upcoming 40% circle rate hike proposed by the Uttar Pradesh government for 2025 further validates the market’s growth trajectory.[7][8]

Investment Strategies for ₹1 Lakh Monthly Rental Goal

| Strategy | Investment_Amount_Crore | Property_Type | Expected_Area_Sqft | Location | Monthly_Rental_Income | Annual_Rental_Yield_% | Loan_Amount_80%_Crore | Down_Payment_Lakh | EMI_Rs | Net_Cash_Flow_Rs | Tax_Benefits_Annual_Rs | Recommended_For |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Commercial Property Focus | 1.5 | Commercial | 1500 | Raj Nagar Extension/Sahibabad | 100000 | 8.0 | 1.2 | 30 | 95574 | 4426 | 309600 | Experienced investors seeking high yields |

| Mixed Portfolio Approach | 2.4 | Mixed (Residential + Commercial) | 2000 | Wave City/Vaishali | 100000 | 5.0 | 1.92 | 48 | 152918 | -52918 | 400000 | Balanced risk investors |

| Premium Residential Focus | 3.75 | Residential (Premium) | 2500 | Indirapuram/Vasundhara | 100000 | 3.2 | 3.0 | 75 | 238934 | -138934 | 706500 | Conservative investors, first-time buyers |

| Affordable Housing Multiple Units | 2.1 | Multiple Residential Units | 3000 | Raj Nagar Extension/Crossings Republik | 100000 | 5.7 | 1.68 | 42 | 133819 | -33819 | 456000 | Investors seeking diversification and steady income |

Commercial Property Focus: The High-Yield Approach

Investment Required: ₹1.50 Crore

Commercial properties in Ghaziabad offer the most efficient path to achieving ₹1 lakh monthly rental income, requiring the lowest capital investment due to superior rental yields of 6-8% annually. Areas like Raj Nagar Extension, Sahibabad, and emerging commercial hubs provide excellent opportunities for retail spaces, office complexes, and mixed-use developments.[9][10][11]

Key Advantages:

- Higher rental yields (8-12% annually) compared to residential properties[11]

- Longer lease tenures (3-5 years) providing stable income streams[12][11]

- Professional tenant base with established businesses and corporates[9]

- Lower maintenance requirements relative to rental income generated[10]

With an investment of ₹1.50 crore and 80% financing, investors can expect monthly EMIs of approximately ₹95,574 using current interest rates, leaving a positive cash flow of ₹4,426 after achieving the rental target.[13]

Mixed Portfolio Strategy: Balanced Risk and Returns

Investment Required: ₹2.40 Crore

A balanced approach combining residential and commercial properties offers 5% annual rental yields while providing portfolio diversification. This strategy allows investors to benefit from both the stability of residential rentals and the higher yields of commercial properties.

Optimal Mix Configuration:

- 60% in prime residential properties (Vaishali, Indirapuram)

- 40% in commercial spaces (office complexes, retail outlets)

- Property size range: 2,000-2,500 square feet total portfolio

- Expected properties: 2-3 units across different micro-markets

Premium Residential Investment: Long-term Capital Appreciation

Investment Required: ₹3.75 Crore

For investors prioritizing capital appreciation and stable rental income, premium residential properties in established locations like Indirapuram and Vasundhara offer 3.2% rental yields with strong growth potential. Despite requiring higher initial investment, these properties provide superior liquidity and tenant quality.

Target Property Profile:

- 2,500 square feet premium apartments or villas

- Locations: Indirapuram, Vaishali, premium sectors of Vasundhara

- Rental range: ₹35-45 per square foot monthly

- Professional tenant base with stable employment

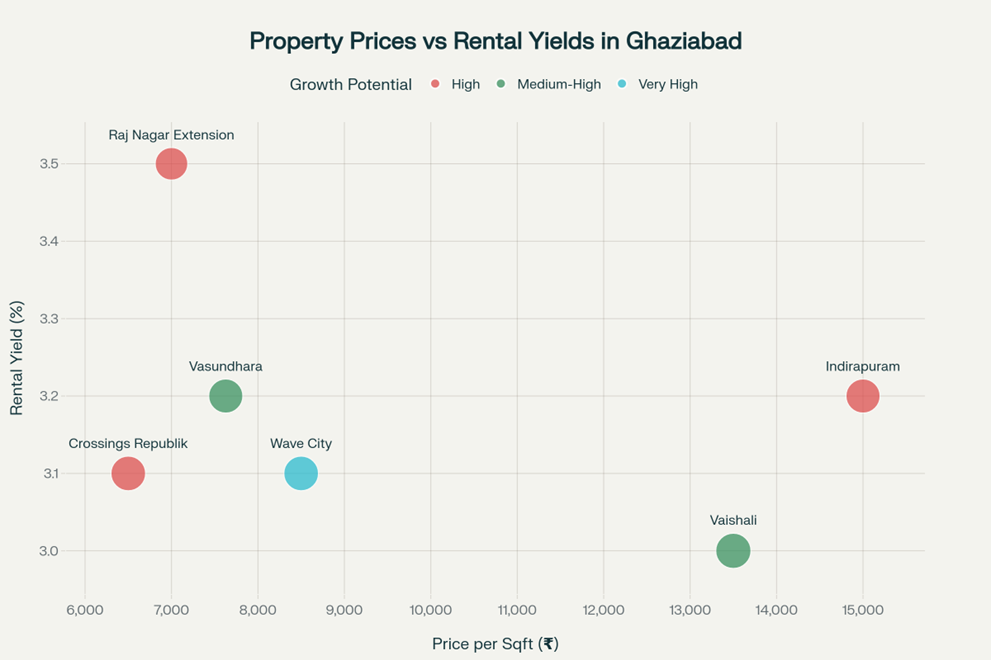

Ghaziabad Areas: Property Price vs Rental Yield Analysis for Investment Decision

Multiple Unit Strategy: Diversification Through Volume

Investment Required: ₹2.10 Crore

Acquiring multiple smaller units in affordable housing segments can generate 5.7% rental yields while spreading risk across different properties and tenant profiles. This approach works particularly well in areas like Raj Nagar Extension and Crossings Republik.

Portfolio Composition:

- 3-4 residential units of 750-1,000 square feet each

- Mix of 2BHK and 3BHK configurations

- Target locations: Raj Nagar Extension, Wave City, Crossings Republik

- Tenant profile: Young professionals, small families, students

EMI vs Rental Income Analysis: Cash Flow Scenarios for Rs 1 Lakh Monthly Rental Goal

Area-wise Investment Analysis

| Area | Price_per_Sqft | Rental_Yield_% | Investment_for_1L_Rental_Crore | Property_Size_Sqft | Growth_Potential | Infrastructure | Best_For |

|---|---|---|---|---|---|---|---|

| Indirapuram | 15000 | 3.2 | 3.75 | 2500 | High | Excellent | Premium residential investment |

| Vaishali | 13500 | 3.0 | 4.0 | 2963 | Medium-High | Very Good | Stable rental income |

| Raj Nagar Extension | 7000 | 3.5 | 3.43 | 4900 | High | Good | Value for money investment |

| Wave City | 8500 | 3.1 | 3.87 | 4553 | Very High | Developing | Long-term capital appreciation |

| Crossings Republik | 6500 | 3.1 | 3.87 | 5954 | High | Good | Budget-conscious investors |

Indirapuram: The Premium Choice

Property Price: ₹15,000 per sq ft | Rental Yield: 3.2% | 5-Year Growth: 73%

Indirapuram stands as Ghaziabad’s most established residential destination, offering world-class infrastructure, premium amenities, and strong capital appreciation. The area’s proximity to Delhi, excellent connectivity via metro and expressways, and established social infrastructure make it ideal for premium residential investments. [1][2]

Investment Highlights:

- Property size needed for ₹1 lakh rental: 2,500 sq ft

- Average rental rates: ₹40-45 per sq ft monthly

- Strong tenant demand from Delhi-NCR working professionals

- Excellent liquidity due to established market presence

Raj Nagar Extension: Value Investment Destination

Property Price: ₹7,000 per sq ft | Rental Yield: 3.5% | 5-Year Growth: 45%

This emerging area offers the best value proposition for investors seeking larger properties at affordable prices. The elevated road connectivity and proximity to employment hubs make it attractive for both residential and commercial investments. [14][6]

Strategic Advantages:

- Property size for ₹1 lakh rental: 4,900 sq ft

- Lower entry barriers for first-time investors

- Strong rental demand from middle-income professionals

- Future appreciation potential due to ongoing infrastructure development

Wave City: Future Growth Hub

Property Price: ₹8,500 per sq ft | Rental Yield: 3.1% | 5-Year Growth: 55%

Wave City represents Ghaziabad’s smart city ambitions with planned infrastructure, integrated township development, and proximity to major expressways. The area is witnessing significant supply addition with over 12,000 new apartments planned in the next three years. [15][6][16]

Investment Considerations:

- Property size requirement: 4,553 sq ft for target rental

- Long-term capital appreciation focus due to planned development

- Modern amenities and integrated township lifestyle

- Higher supply pipeline may impact short-term price growth

Vasundhara: Emerging Opportunity

Property Price: ₹7,628 per sq ft | Rental Yield: 3.2% | 5-Year Growth: 40%

Vasundhara is fast emerging as a 2025 investment hotspot with property rates averaging ₹7,628 per square foot and showing steady appreciation potential. The area offers a balance between affordability and infrastructure development. [17][18]

Financing and Cash Flow Analysis

Home Loan Landscape

Current home loan interest rates in Ghaziabad start from 7.35% annually, with major lenders offering competitive packages. The financing environment remains favorable for property investors, with LTV ratios up to 90% for properties under ₹30 lakh and 80% for higher-value properties. [13]

Optimal Financing Strategy:

- Down payment range: 20-30% of property value

- Loan tenure: 15-20 years for optimal EMI-to-rental ratio

- Interest rate shopping across multiple lenders can save ₹50,000-1,00,000 annually

- Pre-approved loans expedite the acquisition process

Cash Flow Projections

The commercial property strategy offers the only positive cash flow scenario in the initial years, generating ₹4,426 monthly surplus after EMI payments. Other strategies require additional capital support until rental escalations and loan principal reduction improve cash flows.

Year-wise Cash Flow Evolution:

- Years 1-3: Commercial properties show immediate positive returns

- Years 4-7: Mixed portfolios achieve cash flow neutrality

- Years 8-10: Residential investments turn cash flow positive through rental escalations

Tax Benefits and Optimization Strategies

Primary Tax Advantages

Property investment offers substantial tax benefits that significantly enhance overall returns. Under Section 24(b), investors can claim deductions on home loan interest—up to ₹2 lakh annually for self-occupied properties and unlimited amounts for rented properties. [19][20][21]

Key Deduction Categories:

- Section 80C: Principal repayment deductions up to ₹1.5 lakh annually

- Section 24(b): Interest payment deductions (unlimited for rented properties)

- Section 24(a): 30% standard deduction on rental income for maintenance

- First-time buyer benefits: Additional ₹50,000-1.5 lakh under Sections 80EE/80EEA

Advanced Tax Planning

Joint ownership structures can effectively double the available deductions, with each co-owner claiming separate benefits under Sections 24(b) and 80C. This strategy is particularly beneficial for high-income households seeking maximum tax optimization. [20]

Commercial Property Depreciation:

Commercial properties qualify for depreciation deductions, allowing investors to claim a percentage of the property value annually against rental income, further reducing tax liability. [21]

Risk Assessment and Mitigation

Market Risk Factors

Property price volatility remains moderate in Ghaziabad, with established areas showing stable 8-12% annual appreciation over market cycles. However, areas with high supply addition like Wave City may experience short-term price pressure due to oversupply concerns. [3][4][16]

Regulatory risks include the proposed 40% circle rate hike for 2025, which will increase property acquisition costs and stamp duty implications. However, this also validates the government’s confidence in the market’s growth trajectory. [7][8]

Mitigation Strategies

Location diversification across 2-3 micro-markets within Ghaziabad reduces concentration risk while maintaining operational efficiency. RERA compliance verification ensures legal security, while professional property management services minimize operational hassles for investors.

Financial risk management includes maintaining 6-month expense reserves for vacancy periods and ensuring conservative debt-to-equity ratios (maximum 80% financing) to handle interest rate fluctuations.

Investment Timeline and Implementation

Phase 1: Research and Preparation (Months 1-2)

- Market research and area selection based on rental yield targets

- Loan pre-approval from 2-3 lenders for rate comparison

- Budget finalization including all associated costs (registration, legal, furnishing)

Phase 2: Property Acquisition (Months 3-6)

- Property shortlisting and site visits across target locations

- Legal due diligence including title verification and RERA compliance

- Loan processing and documentation completion

- Registration and possession procedures

Phase 3: Rental Generation (Month 7 onwards)

- Property preparation including necessary repairs and furnishing

- Tenant screening and agreement execution

- Rental income commencement and ongoing management

Comparative Analysis: Ghaziabad vs Other NCR Cities

Ghaziabad offers a compelling value proposition compared to other NCR destinations. While Noida requires ₹3.43 crore and Gurugram demands ₹4.00 crore for similar rental targets, Ghaziabad’s commercial properties achieve the goal with just ₹1.50 crore investment.[4]

Competitive Advantages:

- 25-30% lower property prices compared to prime Noida locations

- Similar rental yields (3-3.5%) with better affordability

- Established connectivity through metro and expressway networks

- Lower entry barriers for first-time investors

Future Outlook and Growth Drivers

Infrastructure Catalysts

The Delhi-Ghaziabad-Meerut RRTS corridor completion will further enhance connectivity, potentially driving 15-25% price appreciation in well-connected areas. The Eastern Peripheral Expressway and proposed metro extensions will create new investment hotspots.[6]

Economic Growth Factors

Ghaziabad’s emergence as a commercial and industrial hub with major corporate offices and manufacturing facilities ensures sustained rental demand. The city’s designation as a smart city under government initiatives promises continued infrastructure investment and urban development.[22]

Conclusion and Recommendations

Achieving ₹1 lakh monthly rental income in Ghaziabad is highly feasible through strategic property investment, with commercial properties offering the most efficient path requiring ₹1.50 crore investment. For risk-averse investors, premium residential properties in Indirapuram or Vaishali provide stable returns with strong capital appreciation potential, though requiring higher initial investment of ₹3.75 crore.

The mixed portfolio approach at ₹2.40 crore offers balanced risk-return dynamics, while the multiple unit strategy provides diversification benefits for ₹2.10 crore. Success factors include thorough market research, optimal financing structure, strategic location selection, and professional property management.

With Ghaziabad’s continued infrastructure development, growing employment opportunities, and strategic position in the NCR, property investors can confidently target the ₹1 lakh monthly rental goal while building substantial long-term wealth through capital appreciation. The key lies in matching investment strategy with individual risk appetite, financial capacity, and investment horizon.

- https://www.rprealtyplus.com/news-views/indirapuram-leads-ghaziabad-in-sales-property-prices-surge-73-121195.html

- https://www.hindustantimes.com/real-estate/ghaziabad-real-estate-indirapuram-property-prices-surge-73-in-five-years-driven-by-transport-led-development-101754372695437.html

- https://houssed.com/blog/guides/property-investment-in-ghaziabad-all-you-need-to-know

- https://www.ghar.tv/blog/ghaziabad-vs-noida-real-estate-investment-complete-guide-to-ncr-property-prices-returns/artid3885

- https://www.godigit.com/property-tax/circle-rates/circle-rates-in-ghaziabad

- https://myrealestate.in/blog/ghaziabads-growth-story-how-infrastructure-connectivity-are-shaping-the-housing-market/

- https://timesofindia.indiatimes.com/city/noida/ghaziabad-property-prices-set-to-go-up-as-up-proposes-40-hike-in-circle-rates/articleshow/123954185.cms

- https://therealtytoday.com/news/property-price/ghaziabad-property-prices-to-rise-with-40-circle-rate-hike-proposal/

- https://www.kwgroup.in/blogs/how-beneficial-is-to-buy-commercial-property-in-ghaziabad.html

- https://ganeshhousing.com/residential-vs-commercial-which-gives-better-roi

- https://www.assotechgroup.com/commercial-property-investment-vs-residential-property-investment/

- https://www.svpgroup.in/3-aspects-to-discern-while-investing-in-commercial-property-in-ghaziabad

- https://www.paisabazaar.com/home-loan/ghaziabad/

- https://www.kdmg.in/blog/why-commercial-projects-in-raj-nagar-extension-ghaziabad-is-a-good-place-to-invest-in-2025

- https://www.wavecity.in/blog/investment/ghaziabad-attracts-a-great-number-of-real-estate-investment

- https://www.youtube.com/watch?v=xG9cs5fxyw8

- https://www.instagram.com/realtynxt/p/DOOOe02DJfP/

- https://realtynxt.com/blogs/2025-09-05/ghaziabads-vasundhara-rises-with-7628sqft-rates-rental-yields-40-acre-up-board-expansion

- https://www.aurumproptech.in/blog/tax-benefits-of-investing-in-real-estate

- https://moneytreerealty.com/blog/tax-saving-property-deals

- https://www.sobha.com/blog/tax-benefits-real-estate-investment/

- https://www.wintwealth.com/blog/ghaziabad-residential-real-estate-investment/

- https://www.reddit.com/r/indianrealestate/comments/1n7armr/guidance_on_current_rental_income_yeild_for/

- https://www.skaindia.co.in/blog/what-are-the-top-strategies-to-invest-in-commercial-property-in-ghaziabad/

- https://globalrealtygroup.in/top-5-reasons-to-invest-in-commercial-properties-in-ghaziabad-in-2025/

- https://www.m3mproperties.com/residential/locality/ghaziabad/

- https://www.youtube.com/watch?v=6T9gKQrJWaQ

- https://www.youtube.com/watch?v=Fb0TZbsGnis

- https://realtynxt.com/blogs/2025-03-12/ghaziabads-property-market-top-10-localities-to-buy-a-home

- https://housing.com/commercial/rent/commercial-shop-for-rent-in-ghaziabad-MA4P6wujpumuv5tkcmbj

- https://www.constructionweekonline.in/people/factors-driving-the-growth-of-commercial-real-estate-in-ghaziabad

- https://www.moneycontrol.com/news/business/personal-finance/earning-rs-1-lakh-monthly-rent-thats-still-a-tiny-2-yield-on-your-property-6986411.html

- https://hedgehomes.in/blogs/rental-yield-vs-capital-appreciation-real-estate/

- https://blog.maadiveedu.com/hysense/highest-rental-income-properties-in-india–profitable-investments-in-2025

- https://www.gcglobal.in/monthly-income/

- https://www.reddit.com/r/IndiaBusiness/comments/1krpmp6/3_cr_property_giving_1_lakh_per_month_rental_sell/

- https://realtyassistant.in/blog/commercial-vs-residential-property-in-noida-which-is-a-better-investment

- https://www.kwgroup.in/blogs/best-real-estate-investment-luxury-vs-commercial-delhi-ncr.html

- https://gurus.rediff.com/question/qdtl/money/40-got-5-houses-rental-income-around-1-lakh-current/5229090

- https://www.youtube.com/watch?v=xUZUVHNuDnM

- https://realtyassistant.in/blog/commercial-vs-residential-rentals-what-s-a-better-investment

- https://gurus.rediff.com/question/qdtl/money/hello-retire-early-1-l-monthy-income-46-right-investment/5146835

- https://gaurairocityghaziabad.com/blog/why-consider-ghaziabad-for-commercial-real-estate-investments

- https://www.reddit.com/r/personalfinanceindia/comments/14jgal0/how_much_do_we_need_to_invest_to_earn_15_lacs_per/

- https://www.calculator.net/rental-property-calculator.html

- https://mutualfund.adityabirlacapital.com/investor-education/tools-and-calculator/goal-planning/dream-house

- https://housing.com/home-affordability-calculator

- https://titanwealthinternational.com/calculators/property-investment-calculator/

- https://www.propertypistol.com/investment-calculator

- https://groww.in/blog/best-investment-for-monthly-income-in-india

- https://www.policybazaar.com/home-insurance/property-valuation-calculator/

- https://www.youtube.com/watch?v=aLEUbs5hCKk

- https://www.axisbank.com/retail/loans/home-loan/interest-rates-charges

- https://www.bajajfinserv.in/why-to-invest-in-ghaziabad

- https://www.icicibank.com/personal-banking/loans/home-loan/interest-rates

- https://www.youtube.com/watch?v=jbzLtI2UAus

- https://www.bajajfinserv.in/home-loan-interest-rates

- https://bramhacorp.in/blog-details/tax-benefits-of-investing-in-real-estate/

- https://www.commercialproperty.review/index.php/2024/03/08/know-which-is-better-for-real-estate-investment-noida-or-ghaziabad-or-yamuna-expressway/

- https://www.pnbhousing.com/home-loan/interest-rates

- https://www.idfcfirstbank.com/finfirst-blogs/finance/property-investment-vs-tax-saving-options

- https://gaurairocityghaziabad.com/blog/after-noida-why-ghaziabad-is-the-next-hotspot-for-commercial-real-estate-investments

- https://www.bankbazaar.com/ghaziabad-home-loan.html

- https://tax2win.in/guide/tax-benefits-investing-real-estate

- https://www.wavecity.in/blog/industry-updates/nh-24-the-new-craze-for-property-investment-in-ghaziabad

- https://www.hdfc.com/checklist/home-loan-interest-rates

- https://cleartax.in/s/house-property

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/c6ed36e09f7736bffef061095ac48c22/0eacb264-6ea1-4494-817d-dc241ae84448/225a6a66.csv

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/c6ed36e09f7736bffef061095ac48c22/0eacb264-6ea1-4494-817d-dc241ae84448/1520b629.csv