Inside Jane Street’s Bank Nifty Gambit: How a Wall Street Algo Powerhouse Rattled India’s Options Market

At the peak of India’s 2025 derivatives boom, Jane Street Group—a New-York quantitative giant revered for liquidity provision—was unmasked by the Securities and Exchange Board of India (SEBI) for an audacious Bank Nifty expiry-day scheme that siphoned billions from an overheated options market12. SEBI’s interim order froze ₹4,843 crore in “unlawful gains,” ignited a regulatory rethink of weekly expiries, and exposed how lightning-fast code can muscle an index whose futures volume already dwarfs its cash counterpart by more than 350 times on expiry days34. This article humanises that saga, stitching together the courtroom drama, the trading patches, and the policy shockwaves that followed.

1. Jane Street and India: A Perfect Volatility Storm

Jane Street was founded in 1999 by four Susquehanna alumni and quickly evolved into a 3,000-employee global market-maker trading on 200 venues56. The firm’s low-latency culture naturally gravitated toward India’s derivatives arena, the world’s busiest options market where weekly contracts and generous leverage lure both algorithms and first-time investors73. By FY 25, Bank Nifty options alone clocked an average daily turnover exceeding ₹12,000 crore despite representing no actual share delivery, creating fertile ground for index-level price nudges to cascade into option premiums78.

1.1 Why Bank Nifty, Not Nifty?

Unlike the broad-based Nifty 50, Bank Nifty’s top five lenders command nearly 80% of index weight, meaning heavy trades in just HDFC Bank or ICICI Bank move the entire benchmark9. That concentration made the index cheaper to “steer” intraday, especially on Thursdays when weekly option contracts expired and liquidity was deepest4.

2. Anatomy of the Expiry-Day Playbook

SEBI’s 105-page order details a two-patch script repeated across 15 Bank Nifty expiries and three Nifty expiries between January 2023 and May 2025102.

2.1 Patch I – The Morning Pump (09:15–11:47)

- Jane Street’s Indian subsidiaries bought up to ₹4,370 crore in index constituents and futures, lifting the benchmark artificially114.

- Simultaneously, offshore affiliates amassed massive short-delta exposure by selling costly call options and buying cheap puts, positioning for a fall12.

2.2 Patch II – The Afternoon Dump (11:49–15:30)

- The same entities reversed course, unloading the cash-market inventory, pulling Bank Nifty below its open124.

- Because option Greeks respond non-linearly, a two-percent swing produced windfall gains while underlying losses stayed capped42.

- On 17 January 2024—the textbook case—options profit hit ₹734.9 crore versus ₹61.6 crore of stock losses, a risk-reward profile no ordinary arbitrage could justify2.

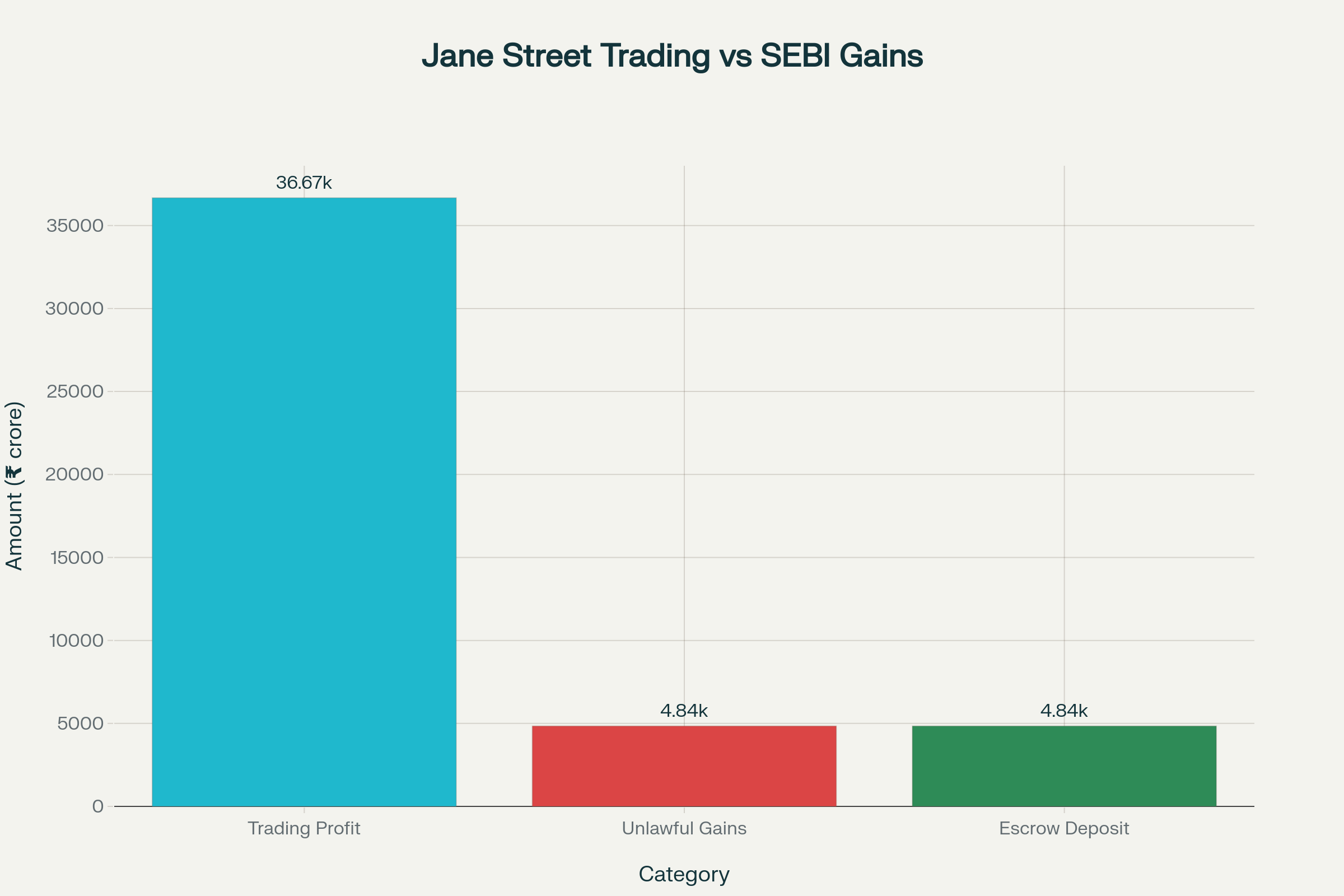

3. The Rupee Impact: Profits, Penalties and Escrow Locks

SEBI tallied Jane Street’s India haul at ₹36,671 crore net, of which ₹4,843 crore was deemed prima facie fraudulent132. The regulator impounded that amount on 3 July 2025, then allowed trading to resume once the firm deposited an equal sum in escrow on 14 July1415.

Jane Street’s Profits vs Impounded Gains

The chart underscores the gulf between total trading profits and the slice regulators froze—fuel for Jane Street’s defence that much of its activity was “index arbitrage, not manipulation.”

4. Red Flags Missed: From U.S. Courtrooms to NSE Surveillance

April 2024: Jane Street sued Millennium Management in New York, claiming two departing traders stole an Indian options algorithm that minted $1 billion in 20231617. Media coverage of that lawsuit spurred NSE to open a file, yet a full SEBI probe began only after six more months of abnormal expiry-day volatility1819.

November 2024: NSE’s internal report labelled the strategy “fraudulent and manipulative,” but enforcement lagged even as SEBI tightened F&O rules in October 2024 to cap weekly expiries820.

July 2025: Facing criticism for regulatory tardiness, SEBI unveiled its interim order hours after suspending Jane Street, calling the case “a sinister scheme that distorted price discovery on India’s most active index”212.

5. Retail Fallout and the Great F&O Reset

SEBI data show 91% of individual F&O traders lost money in FY 25, bleeding over ₹1 lakh crore—statistics the watchdog cited while justifying heavier margins and a single-expiry framework322. New rules effective November 2024 raised index lot sizes (Nifty from 25 to 75; Bank Nifty from 15 to 30) and scrapped multi-index weekly expiries, instantly slashing daily option volumes by up to 33%723. Yet expiry-day turnover still spikes, revealing how behaviour adapts rather than disappears24.

6. Code, Colocation and Microsecond Muscle

High-frequency manipulation relies on:

- Sub-millisecond exchange access via colocated servers, letting algorithms front-run slower counterparties2526.

- Latency-arbitrage models that detect index micro-moves before option implied volatilities adjust2728.

- Cross-entity architecture—Jane Street Singapore and Asia Trading handled derivatives while Indian subsidiaries moved cash stocks, exploiting regulatory silos12.

Academic literature warns that such order-based tactics—spoofing, ramping, momentum ignition—can amplify volatility and erode trust, especially in emerging markets with thin cash depth293031.

7. Policy Lessons and Investor Takeaways

- Surveillance Lag: The 15-month gap between first red flag and enforcement shows tech-savvy firms can outpace conventional monitoring1819.

- Structural Fixes Over Fines: Single-day expiries and larger lot sizes aim to choke the mechanical advantage rather than police every suspicious fill3233.

- Transparency Matters: Sharing probe details with the U.S. SEC under IOSCO protocols may deter cross-border regulatory arbitrage3413.

- Retail Education: With leverage capped and premiums collected upfront, retail traders face clearer cost signals, but speculative pull remains strong—SEBI’s own speeches call for “collective introspection” on sustainability38.

Conclusion

Jane Street’s Bank Nifty saga is a crash course in the double-edged nature of high-frequency innovation. Algorithms that normally narrow spreads can, under certain micro-structure quirks, tilt entire indices and transfer wealth from unsophisticated traders. India’s swift policy pivot—escrow disgorgement, revamped F&O architecture, and tighter surveillance—signals a maturing regulator unwilling to let liquidity trump integrity. For global quants, the episode is a reminder that edge found in code must still honour market fairness; for policymakers, it is proof that shaping market design may work faster than chasing every clever line of C++.

- https://www.steel-eye.com/news/jane-street-fine-566.3m-market-manipulation-sebi-jul-25

- https://www.legal500.com/firms/239038-mansukhlal-hiralal-company/global/news-and-developments/sebi-update-interim-order-against-jane-street-group-for-alleged-index-manipulation

- https://upstox.com/news/market-news/financial-regulations/sebi-flags-unhealthy-imbalance-expiry-day-index-options-turnover-350x-cash-market-volumes/article-178256/

- https://www.moneycontrol.com/news/business/markets/how-jane-street-manipulated-index-closing-on-expiry-days-13228637.html

- https://en.wikipedia.org/wiki/Jane_Street_Capital

- https://www.wikiwand.com/en/articles/Jane_Street_Capital

- https://www.moneycontrol.com/news/business/markets/new-f-o-rules-option-trading-volumes-plunge-across-indices-stocks-12886482.html

- https://www.cnbctv18.com/market/sebi-consultation-paper-on-derivatives-expiry-day-19580710.htm

- https://www.linkedin.com/posts/aaditya-aanand-mb_why-jane-street-choose-to-manipulate-banknifty-activity-7350729596352278528-9MSH

- https://www.tribuneindia.com/news/business/sebi-imposes-highest-ever-penalty-of-rs-4843-57-crore-on-jane-street-group-for-index-manipulation/

- https://funds-axis.com/jane-street-and-the-banknifty-manipulation-a-global-call-for-derivatives-disclosure-reform/

- https://economictimes.com/markets/stocks/news/how-jane-street-targeted-over-40-nifty-nifty-bank-stocks-in-expiry-day-trades/articleshow/122261518.cms

- https://www.business-standard.com/markets/news/sebi-jane-street-high-frequency-trading-case-us-sec-market-index-125072301128_1.html

- https://www.sebi.gov.in/media-and-notifications/press-releases/jul-2025/update-on-interim-order-compliance-by-jane-street_95237.html

- https://www.tribuneindia.com/news/business/sebi-allows-jane-street-to-resume-trading-in-indian-markets-with-certain-restrictions/

- https://economictimes.com/markets/stocks/news/jane-street-millennium-end-india-options-trade-secrets-case/articleshow/116028015.cms

- https://www.bloomberg.com/news/articles/2024-12-05/jane-street-millennium-settle-india-options-trade-secrets-case

- https://indianexpress.com/article/business/nse-sebi-jane-street-stock-market-manipulation-10117813/

- https://economictimes.indiatimes.com/markets/stocks/how-sebis-crackdown-on-jane-street-unfolded-a-15-month-trail-of-scrutiny-and-ignored-warnings/articleshow/122246192.cms?from=mdr

- https://www.ndtvprofit.com/markets/sebi-fo-framework-what-the-markets-regulator-announced-and-what-does-it-mean

- https://www.aljazeera.com/economy/2025/7/18/indias-ban-on-jane-street-raises-concerns-over-regulator-role

- https://www.news18.com/business/how-new-fo-rules-will-imapct-trading-volume-market-experts-explain-9144696.html

- https://www.businessworld.in/article/sebi-rules-decimate-options-trading-in-india-542164

- https://www.financialexpress.com/market/expiry-day-action-soars-as-daily-activity-fizzles-3687967/

- https://www.niceactimize.com/blog/market-manipulation-high-frequency-trading-415/

- https://www.fxpro.com/help-section/education/beginners/articles/high-frequency-trading-strategies

- https://www.investopedia.com/articles/active-trading/092114/strategies-and-secrets-high-frequency-trading-hft-firms.asp

- https://www.daytrading.com/hft-strategies

- https://assets.publishing.service.gov.uk/media/5a7c0c68e5274a13acca301a/12-1055-dr22-high-frequency-trading-and-end-of-day-manipulation.pdf

- https://www.academia.edu/39537684/High_frequency_trading_Order_based_innovation_or_manipulation

- https://www.degruyter.com/document/doi/10.1515/roe-2020-0028/html?lang=de&srsltid=AfmBOorq35XLQjPv5PWv3etqW4PRr5TtS38dKtdQCiGU8NXoe_OoaxRd

- https://www.fortuneindia.com/investing/sebi-tightens-fo-rules-no-daily-expiries-contract-sizes-up-more-expert-explains-impact/118604

- https://www.angelone.in/news/sebi-may-shift-to-fortnightly-expiry-to-curb-index-options-activity-report

- https://upstox.com/news/business-news/latest-updates/sebi-shares-information-with-us-regulator-in-jane-street-market-manipulation-case-report/article-178532/

- https://www.bbc.com/news/articles/c5y0zgrevl1o

- https://www.capitalmind.in/insights/the-saga-of-the-jane-street-trading-scandal

- https://www.newsbytesapp.com/news/business/sebi-slaps-rs4843-crore-penalty-to-lift-ban-on-jane/tldr

- https://www.newsbytesapp.com/news/business/jane-street-manipulated-bank-nifty-derivatives-raked-in-rs4843cr-sebi/tldr

- https://economictimes.com/markets/stocks/news/sebi-allows-jane-street-to-restart-trading-report/articleshow/122805681.cms

- https://ddnews.gov.in/en/sebi-bars-jane-street-over-alleged-bank-nifty-manipulation/

- https://www.newindianexpress.com/business/2025/Jul/21/sebi-lifts-ban-on-jane-street-firm-resumes-trading-after-rs-48435-crore-disgorgement

- https://www.financialexpress.com/market/sebi-allows-jane-street-to-resume-trading-says-group-confims-to-desist-from-unfair-tradenbsp-practice-3922498/

- https://www.theweek.in/news/biz-tech/2025/07/14/jane-street-folds-to-sebi-order-on-market-manipulation-deposits-over-4800-crore-rupees-in-escrow-accounts.html

- https://www.news18.com/business/explained-how-jane-streets-trades-in-indian-stock-market-led-to-rs-4843-crore-unlawful-gains-ws-dkl-9432090.html

- https://www.moneycontrol.com/news/business/markets/criminal-prosecution-against-jane-street-sebi-act-empowers-watchdog-to-seek-fine-and-imprisonment-13243161.html

- https://www.business-standard.com/markets/news/sebi-accuses-jane-street-of-index-manipulation-in-bank-nifty-125072100324_1.html

- https://www.janestreet.com/who-we-are/

- https://www.youtube.com/watch?v=xRnmqz92QGk

- https://www.janestreet.com

- https://www.niftytrader.in/banknifty-intra-volume-pcr-trend

- https://vtrender.com/posts/jane-street-a-deep-dive-into-a-quantitative-trading-powerhouse

- https://www.icicidirect.com/futures-and-options/nifty-option-chain

- https://www.youtube.com/watch?v=I9kIsFoJ8eI

- https://www.icicidirect.com/faqs/fno/why-is-the-lot-size-for-the-30th-january-2025-contract-is-in-lots-of-25-while-the-february-2025-contract-has-a-lot-size-of-75

- https://www.marketswiki.com/wiki/Jane_Street

- https://upstox.com/option-chain/banknifty/

- https://www.nseindia.com/products-services/equity-derivatives-banknifty

- https://www.msei.in/SX-Content/Circulars/2025/July/Circular-17539.pdf

- https://archives.nseindia.com/content/circulars/INVG68921.pdf

- https://www.sebi.gov.in/enforcement/orders/jul-2025/interim-order-in-the-matter-of-index-manipulation-by-jane-street-group_95040.html

- https://nsearchives.nseindia.com/content/circulars/INVG69234.pdf

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5341047

- https://nsearchives.nseindia.com/content/circulars/INVG68921.pdf

- https://www.newsonair.gov.in/sebi-bans-jane-street-from-indian-markets-for-%E2%82%B94843-crore-index-manipulation/

- https://www.taxmann.com/post/blog/sebi-eases-jane-street-restrictions-after-escrow-compliance

- https://www.scribd.com/document/887531865/JaneStreetCaseMarksaTurningPointinSEBIsIndexGovernanceStrategy

- https://www.legal500.com/developments/thought-leadership/sebi-update-interim-order-against-jane-street-group-for-alleged-index-manipulation/

- https://www.rediff.com/business/special/a-showdown-that-could-reshape-indias-derivatives-market/20250720.htm

- https://www.moneycontrol.com/news/business/markets/sebi-likely-to-investigate-jane-street-s-sensex-options-trades-report-13267223.html

- https://devenchoksey.com/articles/India%20Derivatives%20Market%20Manipulation%20-%20Recomendations%209.7.25.pdf

- https://www.abacademies.org/articles/Effect-of-high-frequency-trading-a-study-on-market-1528-2678-26-6-275.pdf

- https://www.ndtvprofit.com/markets/jane-street-investigation-timeline-from-us-courts-to-sebi-crackdown