Real Estate Investment Trusts (REITs) have emerged as a revolutionary investment vehicle in India, democratizing access to premium commercial real estate that was once exclusively available to large institutions and high-net-worth individuals. Since India’s first REIT listing in 2019, this asset class has grown to manage over ₹1,60,000 crores in assets, providing regular income and capital appreciation opportunities to over 2.6 lakh unitholders. For retail investors with zero prior exposure to real estate or stock markets, REITs offer a professionally managed, liquid, and transparent way to participate in India’s thriving commercial real estate sector without the complexities of direct property ownership.

Understanding REITs: The Foundation

What Are REITs and How Do They Work?

A Real Estate Investment Trust (REIT) functions like a mutual fund for real estate investments. REITs are companies that own, operate, or finance income-generating real estate assets such as office buildings, shopping malls, warehouses, and hotels. Just as mutual funds pool money from multiple investors to invest in stocks and bonds, REITs collect capital from numerous investors to purchase and manage large-scale commercial properties.

The fundamental principle behind REITs is simple: they collect rental income from tenants occupying their properties and distribute the majority of this income to investors as dividends 1. When you invest in a REIT, you don’t receive ownership of physical property; instead, you receive units that represent your fractional ownership in the trust’s entire property portfolio.

The Three-Tier Structure of Indian REITs

Indian REITs operate through a sophisticated three-tier structure mandated by SEBI to ensure proper governance and investor protection:

1. Sponsor: Typically a real estate company that previously owned the assets before transferring them to the REIT. The sponsor is responsible for setting up the REIT and appointing the trustee. Sponsors must maintain a minimum 25% stake for the first three years, which can be reduced to 15% thereafter.

2. Manager: A specialized company responsible for day-to-day operations, including property management, making investment decisions, and ensuring regulatory compliance and timely reporting.

3. Trustee: An independent entity that holds REIT assets in trust for unitholders’ benefit. The trustee oversees the manager’s activities and ensures timely dividend distribution.

Income Model and Distribution Mechanism

Revenue Generation

REITs generate income through multiple streams5:

- Rental Income: The primary source, derived from leasing office spaces, retail outlets, or other commercial properties to tenants

- Interest Income: Earned from loans provided to Special Purpose Vehicles (SPVs) that hold properties

- Capital Appreciation: Potential increase in property values over time

Mandatory Distribution Requirements

SEBI regulations mandate that REITs distribute at least 90% of their net distributable cash flows to unitholders at least twice yearly. This requirement ensures that investors receive regular income while preventing management from hoarding cash flows.

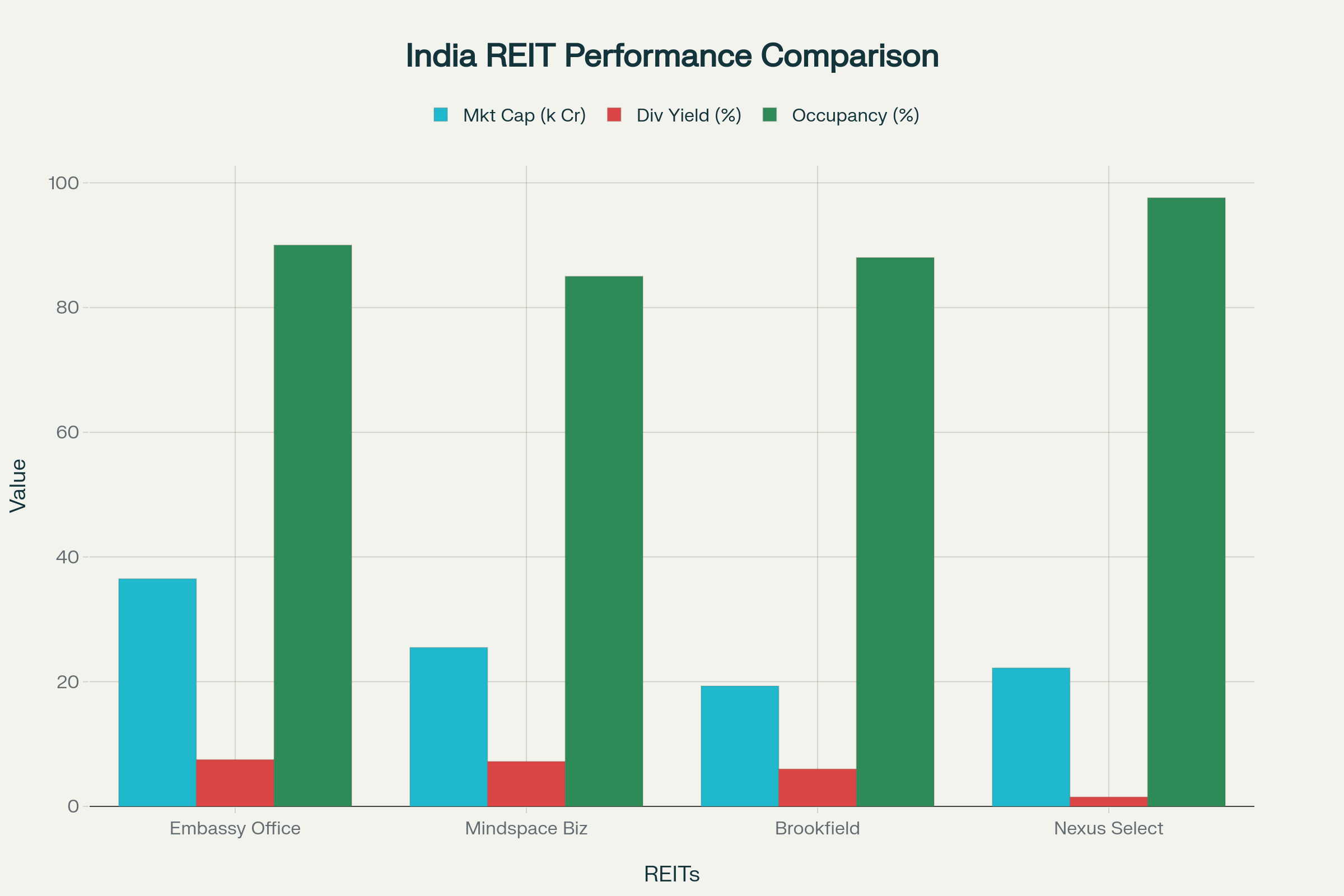

Performance comparison of India’s four listed REITs showing market capitalization, dividend yields, and occupancy rates

The distribution comprises different components with varying tax implications5:

- Dividend income from underlying properties

- Interest income on shareholder loans

- Capital repayment that reduces the unit’s cost basis

Types of REITs in India

By Asset Classification

1. Equity REITs: The most common type in India, these REITs directly own and operate income-generating properties. All currently listed Indian REITs fall into this category.

2. Office REITs: Focus exclusively on commercial office spaces. Embassy Office Parks, Mindspace Business Parks, and Brookfield India REIT are prime examples, owning premium office parks in major IT hubs.

3. Retail REITs: Invest in shopping malls and retail spaces. Nexus Select Trust, India’s first retail REIT, owns and operates shopping centers across the country.

4. Residential REITs: While not yet launched in India, these would focus on residential properties like apartment complexes and housing developments.

Small and Medium REITs (SM REITs)

In a groundbreaking development, SEBI introduced Small and Medium REITs in 2024, targeting fractional ownership platforms and smaller real estate assets. Key features include:

- Asset size: ₹50 crores to ₹500 crores (compared to ₹500 crores minimum for traditional REITs)

- Minimum investment: ₹10 lakh per investor (significantly higher than traditional REITs)

- Asset composition: Can include both commercial and residential properties

- Completion requirement: 95% of assets must be revenue-generating (stricter than traditional REITs’ 80% requirement)

Current Listed REITs in India

Embassy Office Parks REIT

India’s first and largest REIT, launched in March 2019, Embassy Office Parks represents a joint venture between Embassy Group and Blackstone. With a market capitalization of ₹36,511 crores, it owns 33+ million square feet of operational area across Bengaluru, Mumbai, Pune, and NCR. The REIT maintains a strong occupancy rate of approximately 90% and has delivered consistent returns to investors.

Mindspace Business Parks REIT

Established by K Raheja Corp and Blackstone in 2020, Mindspace manages premium office spaces across Mumbai, Hyderabad, Pune, and Chennai8. With a market cap of ₹25,492 crores, it has demonstrated strong performance with a 22.27% return over the past year.

Brookfield India Real Estate Trust

Launched in 2020, Brookfield focuses on Grade-A office assets across India’s top cities, with particular strength in Mumbai, Noida, and Kolkata markets. The REIT has shown robust performance with an 18.40% return over the past year.

Nexus Select Trust

India’s first retail REIT, listed in 2023, Nexus Select Trust has emerged as the top performer with a remarkable 32% return over the past year. Operating shopping malls and retail spaces across prime urban locations, it maintains an impressive occupancy rate of 97.6%.

Investment Process for Retail Investors

Step-by-step process for retail investors to start investing in REITs in India

Step 1: Opening a Demat and Trading Account

The first requirement for REIT investment is opening a demat and trading account with a SEBI-registered broker. This process involves:

- Submitting KYC documents (identity proof, address proof, PAN card)

- Completing the account opening formalities

- Linking your bank account for fund transfers

Step 2: Research and Analysis

Before investing, thoroughly research available REITs by examining:

- Property locations and quality: Assess the micro-markets and tenant profile

- Financial metrics: Review Net Operating Income (NOI), distribution yield, and debt levels

- Management track record: Evaluate the sponsor and manager’s experience

- Occupancy rates: Higher occupancy indicates stable income streams

- Lease expiry patterns: Longer weighted average lease expiry provides income stability

Step 3: Investment Execution

REITs trade on stock exchanges like regular stocks, allowing investors to:

- Place market orders for immediate execution at current prices

- Use limit orders to specify target purchase prices

- Start with small amounts: Minimum investment ranges from ₹10,000 to ₹15,000

Step 4: Monitoring and Management

Post-investment activities include:

- Tracking semi-annual distribution announcements

- Monitoring property acquisitions and developments

- Staying informed about market trends affecting commercial real estate

Dividend Mechanisms and Taxation

Distribution Components and Tax Treatment

REIT distributions have complex tax implications that vary based on the underlying structure:

Tax-Exempt Dividends: When underlying SPVs haven’t opted for the concessional tax regime under Section 115BAA, dividend income remains tax-exempt for unitholders.

Taxable Dividends: If SPVs opt for lower corporate tax rates, dividends become taxable at the investor’s slab rates.

Interest Income: Always taxable at applicable slab rates.

Capital Repayment: Reduces the cost basis of units, affecting capital gains calculations upon sale5.

Capital Gains Taxation

Recent tax amendments have modified REIT capital gains treatment:

- Short-term capital gains (holding period ≤ 1 year): 20% tax rate

- Long-term capital gains (holding period > 1 year): 12.5% without indexation benefits on gains exceeding ₹1.25 lakh

Regulatory Framework and Investor Protection

SEBI’s Comprehensive Oversight

SEBI has established a robust regulatory framework through the REIT Regulations 2014, ensuring investor protection through multiple mechanisms:

Mandatory Disclosures: REITs must provide detailed information about assets, financial performance, and management decisions.

Independent Valuations: Annual comprehensive asset valuations by qualified, independent valuers ensure transparency in asset pricing.

Governance Standards: The three-tier structure with independent trustees provides checks and balances on management decisions.

Key Regulatory Safeguards

Minimum Asset Requirements: Traditional REITs must maintain assets worth at least ₹500 crores, ensuring scale and diversification.

Distribution Mandates: The 90% distribution requirement prevents cash hoarding and ensures regular investor returns.

Leverage Limits: Maximum debt-to-total assets ratio of 49% prevents excessive borrowing.

Lock-in Periods: Sponsor stake requirements ensure alignment of interests between promoters and investors.

Comparative Analysis: REITs vs. Direct Real Estate Investment

Advantages of REITs

Liquidity: Unlike physical real estate, REIT units can be bought and sold instantly on stock exchanges during market hours.

Lower Entry Barriers: Minimum investment of ₹10,000-15,000 makes REITs accessible compared to crores required for premium commercial properties.

Professional Management: Experienced real estate professionals handle property management, tenant relations, and strategic decisions.

Diversification: Single REIT investment provides exposure to multiple properties across different locations and tenant types.

Transparency: Listed REITs follow stringent disclosure norms, providing regular updates on performance and operations.

Limitations Compared to Direct Investment

Limited Control: Investors cannot influence property management decisions or asset allocation strategies.

Market Volatility: REIT prices fluctuate with stock market movements, introducing additional volatility beyond real estate fundamentals.

Tax Complexity: Multiple distribution components with different tax treatments require careful tax planning.

Risk Factors and Considerations

Market-Specific Risks

Interest Rate Sensitivity: REITs are sensitive to interest rate changes, as higher rates increase borrowing costs and make fixed-income alternatives more attractive.

Economic Cycles: Commercial real estate demand fluctuates with economic conditions, affecting occupancy rates and rental income.

Sector Concentration: Most Indian REITs focus on office spaces, creating concentration risk if the IT sector experiences downturns.

Operational Risks

Tenant Concentration: Heavy dependence on major tenants creates vulnerability if key lessees relocate or downsize.

Geographic Concentration: REITs focused on specific cities face local market risks.

Regulatory Changes: Modifications to REIT regulations or taxation policies can impact returns.

Future Outlook and Emerging Opportunities

Small and Medium REITs Revolution

The introduction of SM REITs represents a significant democratization of real estate investment, potentially bringing thousands of smaller properties under regulated structures. This development could:

- Expand investment opportunities beyond major metros

- Include residential properties in REIT structures

- Provide regulation to the growing fractional ownership sector

Market Expansion Prospects

Industry experts anticipate significant growth in the Indian REIT market, driven by:

- Increasing institutional and retail investor awareness

- Growing commercial real estate development

- Potential inclusion of new asset classes like data centers and logistics facilities

- Enhanced liquidity through broader market participation

Conclusion

Real Estate Investment Trusts represent a paradigm shift in how Indian retail investors can access commercial real estate investments. By providing professional management, regular income distribution, liquidity, and transparency, REITs eliminate many traditional barriers to real estate investment while offering exposure to India’s dynamic commercial property market.

For beginners, REITs offer an ideal entry point into real estate investing without requiring substantial capital, property management expertise, or dealing with the complexities of direct ownership. The regulatory framework established by SEBI provides robust investor protection, while the mandatory distribution requirements ensure regular income flow.

However, potential investors must understand the tax implications, market risks, and the fact that REIT performance depends on both real estate fundamentals and stock market dynamics. With proper research and a long-term investment horizon, REITs can serve as an excellent diversification tool for retail portfolios, providing exposure to institutional-quality real estate assets that generate consistent income while offering potential for capital appreciation.

As the Indian REIT market continues to evolve with new asset classes and the introduction of SM REITs, retail investors have unprecedented opportunities to participate in the country’s real estate growth story through professionally managed, transparent, and liquid investment vehicles.