The Alarming Reality of India’s Wealth Concentration: How 1,687 People Control Half the Nation’s Resources

India’s economic landscape presents a stark paradox: while the nation celebrates record-breaking growth and an expanding number of billionaires, an unprecedented concentration of wealth has emerged that surpasses even the inequalities witnessed during British colonial rule. The latest M3M Hurun India Rich List 2025 reveals that just 1,687 individuals possess wealth equivalent to nearly half of India’s GDP, accumulating a combined fortune of ₹167 lakh crore. This concentration represents not merely a statistical anomaly but a fundamental transformation of India’s economic structure that demands urgent examination and intervention.[1][2]

The scale of this wealth concentration becomes evident when examining the broader distribution patterns. According to the World Inequality Lab’s comprehensive analysis, the top 1% of India’s population now controls 40.1% of the nation’s wealth, while the bottom 50% – representing approximately 700 million people – holds a meager 6.4% of total wealth. This disparity has reached levels that researchers describe as creating a “Billionaire Raj” more unequal than the British Raj, with the top 1% income share standing at 22.6% in 2022-23, the highest recorded since data collection began in 1922.[3][4][5]

Wealth distribution across different population segments in India shows extreme concentration at the top

The Accelerating Pace of Wealth Accumulation

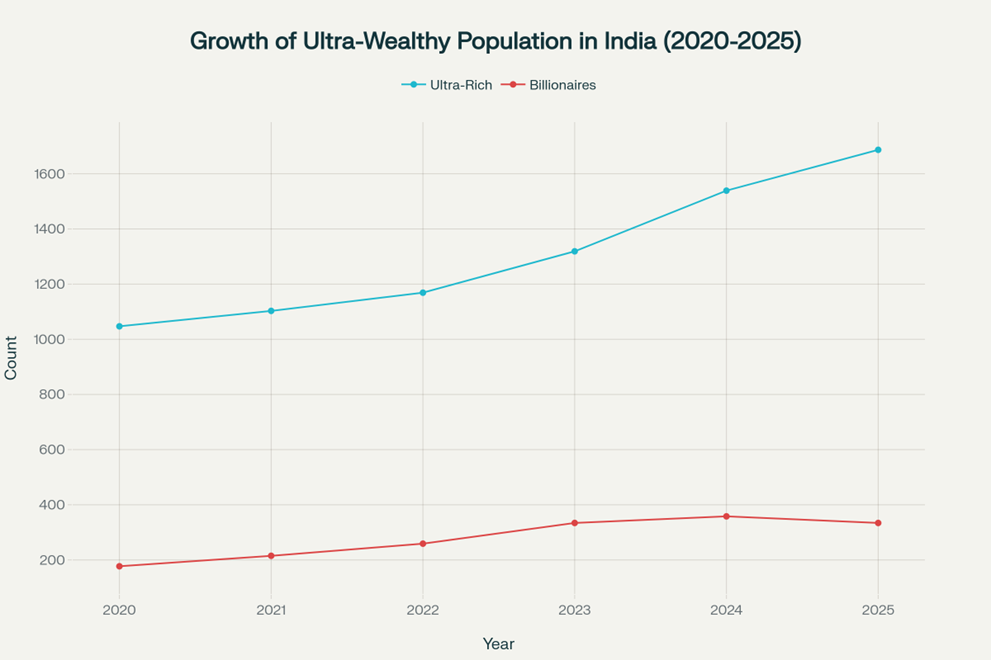

The velocity of wealth creation at the top echelons of Indian society has reached extraordinary levels. India has been adding approximately one new billionaire every week for the past two years, with the collective wealth of ultra-rich individuals growing by ₹1,991 crore daily. The number of individuals worth over ₹1,000 crore has grown from 1,047 in 2020 to 1,687 in 2025, representing a 61% increase in just five years. This rapid accumulation has occurred alongside India’s overall economic expansion, but the benefits have been distributed in an increasingly skewed manner. [1][6][2][7]

The number of ultra-rich individuals in India has grown consistently, with 1,687 people now holding over ₹1,000 crores

The geographic concentration of this wealth further emphasizes the uneven nature of India’s development. Maharashtra alone houses 548 ultra-rich individuals, more than the entire eastern half of the country combined, while Delhi follows with 223 such individuals. Ten states account for over 90% of the country’s prosperity, with Mumbai, Delhi, Bengaluru, Chennai, Hyderabad, and Ahmedabad serving as the primary wealth centers. This concentration reflects not just individual success but systemic advantages in infrastructure, financial networks, and policy support that benefit these metropolitan areas.[1]

Inflation as a Tool of Wealth Redistribution

The relationship between inflation and wealth inequality in India reveals a particularly insidious mechanism through which economic disparities are perpetuated and amplified. Research from the World Inequality Lab demonstrates that inflation does not affect all income groups equally, functioning instead as a regressive force that systematically disadvantages the poor while providing relative protection to the wealthy.[8][9][10]

Poor households face significantly higher inflation rates than wealthy households, creating a regressive burden

The differential impact of inflation manifests most clearly in consumption patterns. Poor households allocate over 50% of their budget to food items, compared to less than 30% for wealthy households. When food prices experience volatile swings – as they frequently do due to supply chain disruptions, weather events, or global commodity price fluctuations – poor families bear a disproportionate burden. In 2024, the poorest 5% of Indian households faced an inflation rate of 6.4%, while the richest 5% experienced only 4.7% inflation.[8][9]

This disparity occurs because wealthy households maintain diversified consumption baskets that include non-essential items and services whose prices tend to be more stable. Additionally, affluent families can substitute expensive items with alternatives, delay purchases during price spikes, or absorb higher costs without significantly impacting their standard of living. Poor households lack these buffers and must continue purchasing essential items regardless of price increases, making them price-takers in the most vulnerable sense.[10][8]

The wealth transfer mechanism operates through multiple channels. First, inflation erodes the real value of cash holdings and fixed-income investments, which constitute a larger portion of poor households’ limited assets. Simultaneously, it reduces the real burden of debt, primarily benefiting those with access to credit – typically middle-class and wealthy individuals with mortgages and business loans. Second, asset owners benefit from nominal price appreciation in real estate, stocks, and commodities, assets predominantly held by wealthy individuals.[11][12][13][14][15][16]

Research indicates that during periods of high inflation, such as during the COVID-19 pandemic and the Russia-Ukraine conflict, the poor consistently experienced higher inflation rates than official averages. This pattern suggests that conventional monetary policy, which targets average inflation rates, may inadvertently perpetuate inequality by failing to account for differential price exposure across income groups.[9][8][10]

Structural Drivers of Increasing Inequality

The concentration of wealth in India results from a complex interplay of structural, policy, and social factors that have evolved over decades but accelerated significantly since economic liberalization. The shift from public investment-led growth to debt-financed private consumption by elites has fundamentally altered the economy’s distributive mechanisms. Manufacturing’s stagnant share in GDP, combined with the dominance of capital-intensive services like financial services and telecommunications, has limited employment generation despite robust economic growth.[17][18]

Educational disparities play a crucial role in perpetuating wealth concentration. Access to quality education remains strongly correlated with family income, creating intergenerational transmission of advantage. The poorest households often cannot afford the opportunity costs of education, keeping children in low-productivity activities and limiting their future earning potential. Meanwhile, wealthy families invest heavily in their children’s human capital development, securing positions in high-paying sectors.[19][20][17]

Caste-based discrimination continues to influence wealth distribution patterns, with 88.4% of billionaire wealth concentrated among upper castes while Scheduled Tribes have no representation among India’s wealthiest individuals. This disparity extends beyond individual wealth to systemic barriers in access to credit, business networks, and market opportunities that enable wealth creation.[3][19]

The financialization of the economy has created new mechanisms for wealth concentration. Asset price inflation in real estate and financial markets has primarily benefited existing asset holders, while wage growth has lagged behind productivity gains. The expansion of capital markets and complex financial instruments has provided sophisticated wealth management tools for the affluent while leaving the majority of the population dependent on traditional savings mechanisms that lose value during inflationary periods.[11][15][21][17]

Policy choices have inadvertently reinforced these trends. Tax policies that favor capital gains over wage income, insufficient wealth taxation, and regressive indirect tax structures have contributed to after-tax income concentration. Inadequate labor market regulations and weak collective bargaining institutions have limited workers’ ability to claim their share of productivity gains.[22][23][24][17]

The Macroeconomic Consequences of Extreme Concentration

The concentration of wealth in India carries profound macroeconomic implications that extend beyond distributional concerns. High inequality can constrain long-term economic growth through multiple channels. When large portions of the population have limited purchasing power, domestic demand remains subdued, forcing the economy to rely heavily on exports or investment by the wealthy for growth sustainability.[25][26]

The consumption patterns of different income groups create distinct economic multipliers. Poor and middle-class households spend a higher proportion of additional income on goods and services, generating broader economic activity through the multiplier effect. Wealthy households, having satisfied their consumption needs, tend to save or invest additional income in financial assets that may not immediately translate into productive economic activity.[11][13][27]

Extreme wealth concentration also creates financial fragility. When a significant portion of assets is held by a small number of individuals, market volatility can have outsized effects on overall economic stability. The interconnectedness of wealthy individuals’ investment portfolios can amplify systemic risks during financial crises.[26]

Political economy considerations further complicate the situation. Concentrated wealth translates into concentrated political influence, potentially skewing policy decisions toward the interests of the wealthy rather than broader social welfare. This dynamic can perpetuate inequality through policy choices that favor capital over labor, reduce progressive taxation, or limit social spending.[2][17][21][24][26]

Regional Implications and Urban-Rural Divides

The geographic concentration of wealth in India reflects deeper structural imbalances that affect regional development patterns. The dominance of ten states in wealth creation has created a two-speed economy where prosperity clusters in urban centers while vast rural areas remain economically marginalized. This concentration perpetuates regional inequalities and limits balanced national development.[1][20]

Rural areas, home to nearly 70% of India’s population, remain dependent on agriculture and allied activities that have experienced stagnant productivity growth. The lack of industrial diversification in rural regions, combined with inadequate infrastructure and limited access to credit and markets, constrains income-generating opportunities for rural households.[20][18][28]

The migration of talented individuals from economically disadvantaged regions to wealthy metropolitan areas further exacerbates regional disparities. This brain drain deprives struggling regions of human capital while concentrating intellectual resources in already prosperous areas, creating a self-reinforcing cycle of regional inequality.[1][20]

Policy Implications and Potential Solutions

Addressing India’s extreme wealth concentration requires comprehensive policy interventions across multiple dimensions. Progressive taxation reforms represent the most direct mechanism for reducing inequality. Implementing wealth taxes on ultra-rich individuals, strengthening capital gains taxation, and ensuring effective implementation of existing progressive income tax structures could generate substantial revenue for redistribution.[17][19][24]

The introduction of a super tax on billionaires and multimillionaires, as suggested by various policy analysts, could fund major investments in education, healthcare, and infrastructure. Research indicates that a 2% wealth tax on Indian billionaires could support nutrition programs for India’s malnourished population for three years, while a 1% wealth tax could fund the National Health Mission.[19][24][17]

Employment generation policies must prioritize labor-intensive sectors and skill development programs that enable workers to participate in higher-productivity activities. Strengthening minimum wage regulations, expanding social security coverage, and supporting micro, small, and medium enterprises can improve income distribution while promoting economic growth.[22][24][17]

Educational reforms focused on improving access and quality for disadvantaged groups are essential for long-term inequality reduction. Universal access to quality public education, combined with targeted support for marginalized communities, can enhance social mobility and break intergenerational transmission of poverty.[17][19]

Land reforms and rural development initiatives can address regional disparities by improving agricultural productivity and creating non-farm employment opportunities in rural areas. Investment in rural infrastructure, including digital connectivity, transportation networks, and financial services, can integrate rural economies with broader national development.[28][22][19][17]

Financial inclusion policies must ensure that all households have access to formal financial services, including credit, insurance, and investment opportunities. This access can help poor households build assets and protect against economic shocks while reducing their vulnerability to informal financial systems that often perpetuate poverty.[24][19]

The Path Forward: Toward Inclusive Growth

India’s current trajectory toward extreme wealth concentration is neither inevitable nor sustainable. The country faces a critical choice between continuing on a path that enriches a tiny elite while marginalizing hundreds of millions of people, or pivoting toward inclusive growth models that share prosperity more broadly. International experience demonstrates that countries can achieve both high growth and relatively equitable distribution through appropriate policy frameworks.[29][23][26]

The immediate priority must be acknowledging that current inequality levels threaten social cohesion and democratic stability. When the bottom 50% of the population shares less than 7% of national wealth while facing higher inflation rates and limited economic opportunities, the foundations of social solidarity erode. Historical analysis suggests that such extreme inequalities can trigger political upheaval and social unrest if left unaddressed.[3][4][8][21][26]

Reform efforts must be comprehensive and sustained, addressing both the symptoms and root causes of inequality. This includes not only redistributive policies but also structural reforms that ensure economic growth benefits all segments of society. Creating an economy where opportunity is more widely distributed, where public services provide effective social mobility ladders, and where economic policy considers distributional impacts alongside aggregate growth, represents the pathway toward a more equitable and sustainable development model.[17][19][26]

The concentration of wealth in the hands of 1,687 individuals while hundreds of millions struggle with basic needs represents more than an economic challenge – it reflects fundamental questions about the kind of society India aspires to become. Addressing this concentration is not merely about reducing inequality but about building an economy that serves all citizens and maintains the social contract essential for democratic governance. The time for action is now, before these disparities become even more entrenched and difficult to reverse.[2][21][26]

- https://www.financialexpress.com/money/insights/indias-billionaires-live-in-just-ten-states-and-the-rest-are-watching/3999523/

- https://economictimes.com/news/politics-and-nation/modi-govt-promoting-concentration-of-wealth-its-direct-attack-on-soul-of-democracy-congress/articleshow/124317477.cms

- https://www.ndtv.com/india-news/world-inequality-report-over-85-of-indian-billionaires-from-upper-castes-none-from-scheduled-tribes-5974949

- https://wid.world/www-site/uploads/2024/03/WorldInequalityLab_WP2024_09_Income-and-Wealth-Inequality-in-India-1922-2023_Final.pdf

- https://wid.world/news-article/inequality-in-india-the-billionaire-raj-is-now-more-unequal-than-the-british-colonial-raj/

- https://hurunindia.com/media-release/details/?id=674d305fcf08e188628b90cd

- https://economictimes.com/news/new-updates/rs-211900000000-at-just-31-this-chennai-born-founder-becomes-indias-youngest-billionaire/articleshow/124270897.cms

- https://wid.world/document/measuring-inflation-inequality-in-india-world-inequality-lab-working-paper-2025-10/

- https://newsreel.asia/articles/inflation-india-inequality-rich-poor-divide

- https://wid.world/news-article/inflation-and-high-volatility-hit-the-poor-harder-in-india/

- https://www.bankofcanada.ca/wp-content/uploads/2010/08/doekpe.pdf

- https://www.forbes.com/sites/jackkelly/2024/04/08/how-inflation-benefits-the-wealthy-and-harms-the-working-class/

- https://www.stlouisfed.org/publications/regional-economist/2022/aug/impact-inflation-wealth-transfer-effect

- https://www.vedantu.com/commerce/effects-of-inflation-on-production-and-distribution-of-wealth

- https://www.journals.uchicago.edu/doi/10.1086/508379

- https://www.whitecoatinvestor.com/inflation-is-not-good-for-the-wealthy/

- https://www.drishtiias.com/daily-updates/daily-news-editorials/unjust-disparities-a-closer-look-at-inequality-in-india

- https://en.unesco.org/inclusivepolicylab/sites/default/files/analytics/document/2019/4/wssr_2016_chap_16.pdf

- https://believersias.com/income-inequality-in-india-challenges-and-solutions/

- https://www.sciencedirect.com/science/article/abs/pii/S0143622824000729

- https://economictimes.com/news/new-updates/1-hold-40-wealth-financial-analyst-says-income-gap-in-india-now-worse-than-under-british-rule/articleshow/122202319.cms

- https://edukemy.com/blog/measures-to-decrease-inequality-in-india-upsc-economy-notes/

- https://policy-practice.oxfam.org/resources/tackling-extreme-inequality-in-india-620196/

- https://forumias.com/blog/status-of-inequality-in-india-explained-pointwise/

- https://www.theindiaforum.in/economy/trends-economic-inequality-india

- https://www.policycircle.org/economy/economic-inequality-solutions/

- https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2904~27941cd33f.en.pdf

- https://www.jetir.org/papers/JETIR2310318.pdf

- https://www.imf.org/en/Publications/fandd/issues/2018/03/bourguignon

- https://kuvera.in/blog/indian-billionaires-hurun-rich-list-2024/

- https://www.businesstoday.in/latest/trends/story/top-1-holds-40-of-wealth-financial-analyst-warns-indias-wealth-gap-is-worse-than-british-era-483196-2025-07-04

- https://www.hindustantimes.com/india-news/wheres-gen-z-among-richest-indians-hurun-list-2025-shows-whos-got-the-money-101759309221199.html

- https://www.360.one/Content/Report/360ONE-Wealth-Hurun-India-Rich-List-2023.pdf

- https://www.aljazeera.com/economy/2024/4/29/is-modis-india-more-unequal-than-under-british-rule

- https://www.scribd.com/document/768575059/2024-HURUN-INDIA-RICH-LIST-Hurun-India

- https://hurunindia.com

- https://english.hindusthansamachar.in/Encyc/2025/10/5/Congress-Alleges-Rising-Economic-Inequality-Says.php

- https://hurunindia.com/blog/2024-hurun-india-rich-list/

- https://visionias.in/current-affairs/monthly-magazine/2024-05-21/economics-(indian-economy)/high-income-and-wealth-inequality-in-india

- https://x.com/NH_India/status/1974739781369139264

- https://hurunindia.com/pillars/wealth/india-rich-list/

- https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=154837&ModuleId=3

- https://pmc.ncbi.nlm.nih.gov/articles/PMC10653499/

- https://www.linkedin.com/pulse/how-inflation-affects-middle-class-vs-rich-brief-study-y9qof

- https://indianexpress.com/article/explained/high-inflation-india-hit-rich-poor-7919215/

- https://www.sciencedirect.com/science/article/pii/S0954349X2500058X

- https://www.investopedia.com/articles/insights/122016/9-common-effects-inflation.asp

- https://timesofindia.indiatimes.com/blogs/spreading-light/inflation-friend-of-the-rich-enemy-of-the-lower-income-earners/

- https://www.economicshelp.org/blog/315/inflation/inflation-advantages-and-disadvantages/

- https://www.altnews.in/fact-check-did-finance-ministry-say-richest-facing-more-inflation-than-poorest/

- https://www.oecd.org/en/data/datasets/income-and-wealth-distribution-database.html

- https://www.reddit.com/r/AskIndia/comments/1gffqj0/how_do_we_solve_income_inequality_in_our_country/

- https://en.wikipedia.org/wiki/Income_inequality_in_India