The Multiverse of Economy: How Black Money is Converted to White Through Land Transactions in India

India’s real estate sector has long served as one of the most effective conduits for money laundering, with sophisticated mechanisms enabling the transformation of illicit funds into legitimate assets. Despite numerous regulatory reforms and enforcement measures, the conversion of black money through land transactions remains a persistent challenge, involving complex networks of intermediaries, regulatory loopholes, and systemic weaknesses that facilitate large-scale financial crimes.

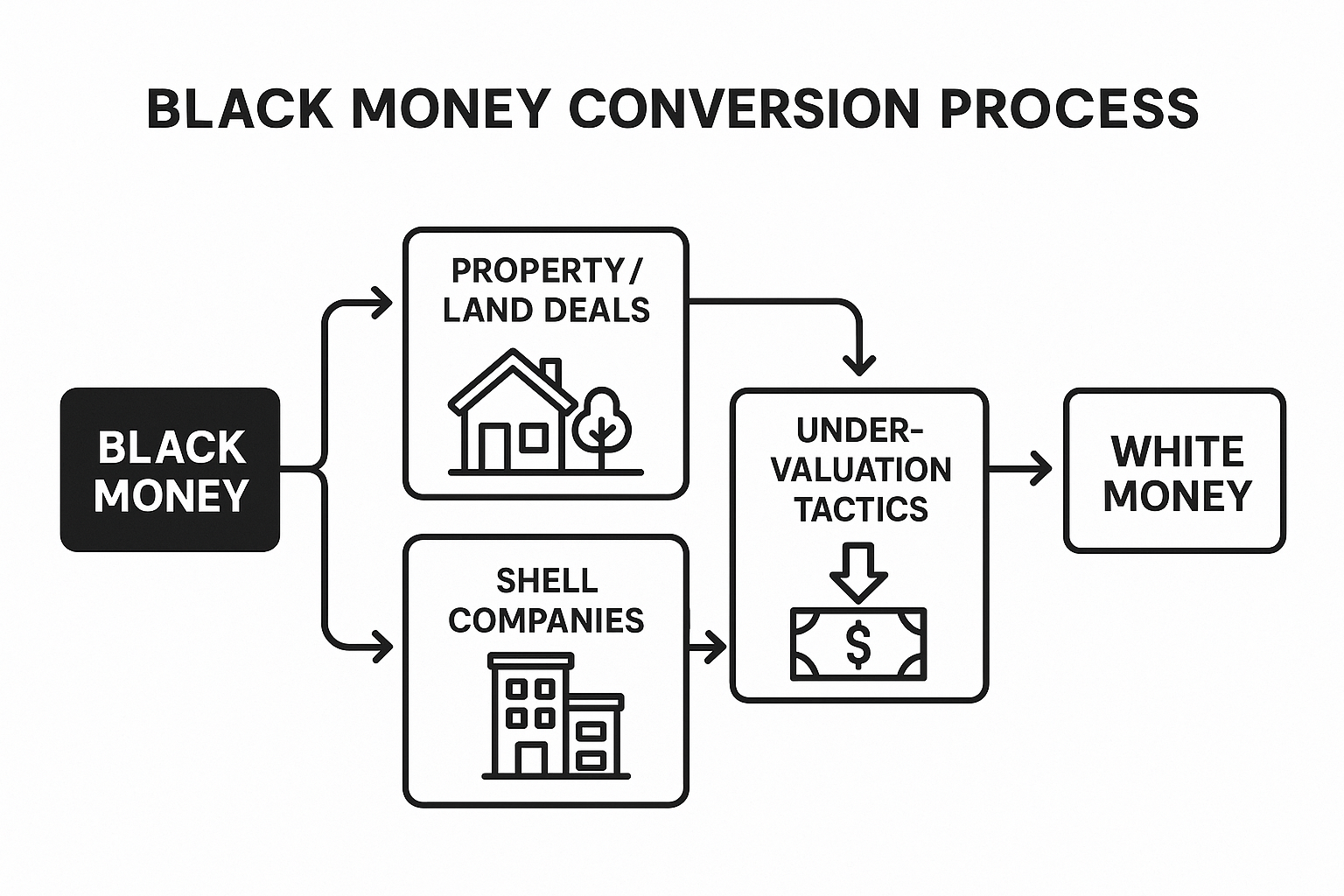

Methods of Black Money Conversion Through Land Transactions in India

Traditional Mechanisms of Money Laundering Through Real Estate

The Under-Valuation Strategy

The most prevalent method involves systematic under-reporting of property values in official transaction documents. According to the National Institute of Public Finance and Policy (NIPFP) study, this practice enables the conversion of 66 to 73 percent of declared property values into black money. The mechanism works through a simple yet effective process: a property worth ₹10 crore is officially registered at ₹2 crore, with the remaining ₹8 crore paid in cash. The seller, often a farmer operating outside the tax system, accepts the cash payment without reporting it. businesstoday+3

The Delhi market provides stark evidence of this practice, with fair market values frequently exceeding declared considerations by 200-400 percent. Properties with actual values of ₹40-50 lakh are routinely registered for amounts below ₹10 lakh to avoid the pre-emptive purchase provisions under Chapter XXC of the Income Tax Act. This systematic undervaluation not only facilitates tax evasion but creates a parallel pricing structure that distorts the entire real estate market. nipfp

Power of Attorney Transfers

Real estate transactions increasingly rely on Power of Attorney (POA) mechanisms to circumvent formal registration requirements. These transfers allow property ownership changes without triggering stamp duty, registration fees, or capital gains tax obligations. The practice has become so widespread that regulatory authorities have proposed making POA transfers compulsorily registrable, particularly in Delhi, to close this significant loophole. nipfp+1

Agricultural Land Laundering Schemes

Perhaps the most sophisticated traditional method involves agricultural land transactions, which historically enjoyed exemption from capital gains taxation. The scheme operates through a two-stage process: first, purchasing agricultural land significantly below market value through cash payments, then selling the same land at full market value through legitimate banking channels. This mechanism effectively converts ₹8 crore of black money into white funds in transactions involving ₹10 crore properties. businesstoday+2

However, a landmark ruling by the Ahmedabad bench of the Income Tax Appellate Tribunal (ITAT) in May 2025 has threatened to close this avenue. The tribunal determined that Section 56(2)(x) of the Income Tax Act applies to agricultural land, making the difference between market value and declared transaction price taxable as “income from other sources”. This interpretation, if upheld by higher courts, would eliminate decades of agricultural land-based money laundering. caalley+2

Modern Sophisticated Methods

Shell Company Networks

Contemporary money laundering schemes employ complex networks of shell companies to create multiple transaction layers. These entities, often registered with minimal assets and fictitious addresses, facilitate circular trading patterns that obscure the ultimate beneficial ownership of funds. Government investigations have identified over 200,000 shell companies operating in India, with many specifically created to facilitate real estate money laundering. indiatoday+2

The Patanjali Group case exemplifies this approach, where investigators uncovered a web of dubious shell companies controlled by politically exposed persons to buy Aravalli forestland and convert it for real estate development. These companies collected ₹6.74 crore as advances and application money for shares, subsequently earning ₹15.16 crore through land sales while maintaining opaque beneficial ownership structures. reporters-collective

Circular Trading Mechanisms

Circular trading involves identical buy and sell orders between related entities, creating artificial transaction volumes without genuine ownership changes. In real estate contexts, this mechanism enables the layering of illicit funds through multiple seemingly independent transactions. Company A sells to Company B, which sells to Company C, which returns the transaction to Company A, effectively laundering money while maintaining the appearance of legitimate business activity. precisa+2

Split Transaction Strategies

To avoid detection thresholds, sophisticated operators employ transaction splitting techniques. Large money transfers are broken into smaller amounts below the ₹10 lakh reporting threshold, with multiple individuals or entities conducting these fractional transactions over extended periods. The Gujarat Income Tax Department’s manual specifically identifies this as a tried-and-tested money laundering method. economictimes+1

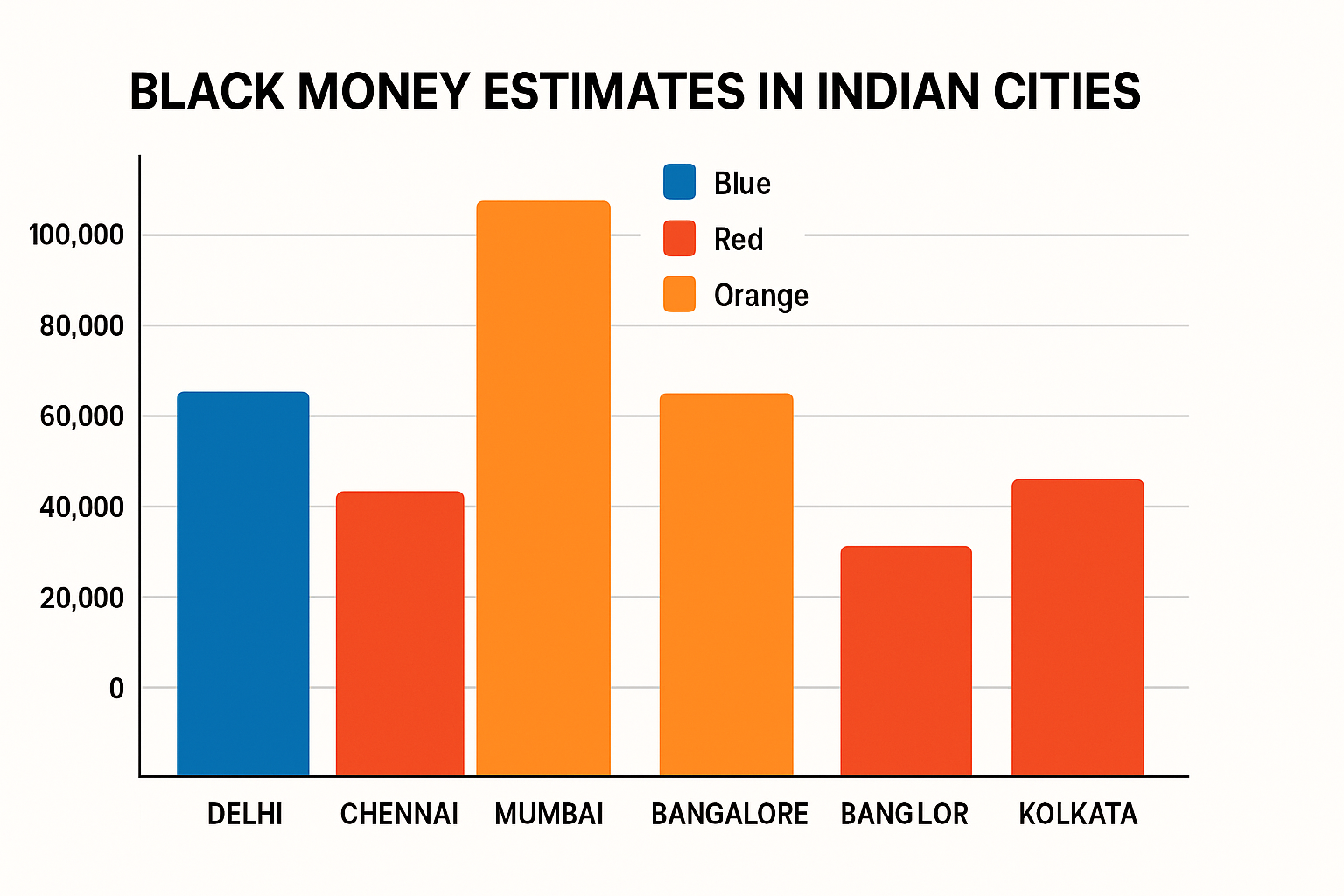

Quantitative Analysis of Black Money in Real Estate

Black Money Estimates in Indian Real Estate Sector by Metropolitan City

The scale of money laundering through real estate transactions reveals the magnitude of this challenge. NIPFP research analyzing Income Tax Department data from Chapter XXC cases provides the most comprehensive quantitative assessment of black money flows in India’s metropolitan real estate markets. nipfp

Contemporary Impact Assessment

Modern surveys confirm the persistence of these practices. According to a 2024 national survey, 90% of Indians believe black money still plagues the real estate sector, with nearly half of recent property buyers admitting to paying portions of their transactions in cash. The cash component in secondary market transactions ranges from 20-40% of total property values, with some luxury and land transactions involving 40-60% cash payments. businesstoday+1

High-Profile Cases and Enforcement Actions

The Robert Vadra Land Deal

The Robert Vadra land deal case exemplifies sophisticated black money laundering through real estate transactions. Vadra’s company Skylight Hospitality purchased 3.5 acres of land in Shikohpur for a declared consideration of ₹7.5 crore, though the actual agreed price was ₹15 crore.

The Enforcement Directorate investigation revealed that no genuine payment was made at the time of transaction, with the declared cheque never being encashed to evade stamp duty obligations. The land was subsequently sold to DLF for ₹58 crore, with ₹5 crore routed through M/s Blue Breeze Trading Pvt. Ltd. and ₹53 crore through SLHPL, effectively converting black money into legitimate real estate profits.

The ED provisionally attached 43 immovable properties worth ₹38.69 crore across multiple states, including land in Bikaner, commercial units in Gurugram, Mohali, and Noida, and residential flats in Ahmedabad, demonstrating the multi-layered nature of the money laundering operation.

Vasai Virar Municipal Corporation Scam

The Vasai Virar Municipal Corporation (VVMC) scam demonstrates how organized cartels involving government officials facilitate large-scale black money conversion through illegal land deals. Commissioner Anil Kumar Pawar allegedly established fixed commission rates of ₹20-25 per square foot for development permissions and ₹150 per square foot for ignoring illegal construction on government land.

Key perpetrators Sitaram Gupta and Arun Gupta sold 60 acres of government land based on forged agreements to local builders who constructed 41 illegal buildings. The investigation revealed systematic corruption where bribes paid in black money were legitimized through fake property development permissions, allowing the entire chain of participants to convert illicit funds into apparently legal real estate assets.

The Patanjali Group Case

The Patanjali Group case reveals how politically connected entities used shell company networks to acquire valuable land illegally and convert black money into white assets. Investigators uncovered a web of dubious shell companies controlled by politically exposed persons to purchase Aravalli forestland and convert it for real estate development.

These companies collected ₹6.74 crore as advances and application money for shares, subsequently earning ₹15.16 crore through land sales while maintaining opaque beneficial ownership structures. The scheme involved creating multiple layers of corporate entities to obscure the true source of funds and the ultimate beneficiaries, allowing black money to emerge as legitimate real estate development profits through seemingly legal corporate transactions.

Contemporary ED Actions

Recent Enforcement Directorate operations continue to uncover sophisticated money laundering schemes in the real estate sector. In the Bhasin Infotech case, ED attached a ₹27.01 crore residential property in Delhi’s Rajouri Garden, where funds collected from investors were diverted through a web of group companies rather than being used for promised construction projects. The scheme involved creating multiple corporate entities to layer transactions and obscure fund flows, allowing promoters to convert investor money into personal real estate assets.

Similarly, operations in Noida resulted in seizure of assets worth ₹25.94 crore in cases involving diversion of ₹126.3 crore through equity shares, debentures, and advances to related entities, demonstrating how modern black money conversion relies heavily on complex corporate structures and financial instruments to legitimize illicit funds through real estate investments.

Regulatory Framework and Legal Provisions

Prevention of Money Laundering Act (PMLA) 2002

The PMLA forms the core legal framework for combating money laundering in India’s real estate sector. Under the Act, money laundering constitutes the process of projecting proceeds of crime as untainted property, with punishments ranging from three to ten years of rigorous imprisonment. The Enforcement Directorate possesses extensive powers to attach and confiscate properties involved in money laundering, with provisional attachment orders continuing until trial court convictions are confirmed. enforcementdirectorate+4

Benami Transactions (Prohibition) Act

The Benami Transactions (Prohibition) Act of 1988, amended in 2016, specifically targets property transactions where nominal ownership differs from beneficial ownership. The Act empowers Income Tax Department authorities to attach and confiscate benami properties, with Benami Prohibition Units (BPUs) established to implement enforcement. However, a 2022 Supreme Court judgment declared Section 3(2) unconstitutional due to its arbitrary nature and lack of retrospective application. tuljalegal+3

Real Estate Regulation and Development Act (RERA)

RERA implementation in 2017 introduced significant transparency requirements, mandating 70% of realized funds be deposited in separate bank accounts to cover construction and land costs. The Act requires mandatory project registration, audited accounts verification, and detailed transaction reporting, substantially reducing opportunities for cash-based dealings in the primary residential market. sansad+1

Anti-Money Laundering Guidelines for Real Estate Agents

Recent regulations require real estate agents with annual turnover exceeding ₹20 lakh to implement comprehensive Customer Due Diligence (CDD) procedures and report suspicious transactions. These reporting entities must maintain transaction records, verify client identities, and submit regular compliance reports to the Financial Intelligence Unit (FIU). ahlawatassociates+2

Government Policy Responses and Impact Assessment

Demonetization Effects

The November 2016 demonetization significantly impacted real estate transactions by eliminating high-denomination currency notes commonly used in cash deals. Property registrations declined by 40% during typical home-selling periods, with luxury real estate prices falling 20-30%. However, economists note that demonetization’s long-term effects on black money elimination remain limited, as sophisticated operators adapted through alternative mechanisms. pib+2

GST Implementation Impact

The Goods and Services Tax implementation in July 2017 introduced requirements for registered vendor sourcing to claim input tax credits, theoretically reducing cash components in construction. However, CBIC studies reveal that top builders’ cash GST payments average only 1.7% compared to 4.3-7% for government construction entities, indicating continued evasion. The removal of Input Tax Credit (ITC) for certain housing categories may have inadvertently increased black money opportunities. tallysolutions+3

Banking and Financial Monitoring

Enhanced financial monitoring requires reporting of cash transactions exceeding ₹10 lakh and property purchases above ₹50 lakh. Cross-border wire transfers above ₹5 lakh and suspicious transactions of any amount must be reported to FIU-India. However, enforcement challenges persist due to coordination difficulties between registration authorities and tax departments. nipfp+2

Structural Factors Enabling Money Laundering

Market Concentration and Oligopolistic Behavior

India’s urban real estate markets demonstrate oligopolistic structures with small numbers of controlling agents supporting collusive pricing arrangements. This concentration facilitates black money circulation by limiting competitive pressures and enabling coordinated price manipulation. Traditional oligopoly theories predict that such market structures naturally support non-competitive pricing behaviors that accommodate illicit financial flows. nipfp

Valuation Inconsistencies

The absence of unified valuation methodologies across central, state, and local tax administrations creates opportunities for systematic underreporting. Different government agencies employ disparate property assessment approaches, enabling transaction parties to exploit the most favorable valuations for tax minimization purposes. This regulatory fragmentation undermines efforts to establish consistent market pricing transparency. nipfp

Information Asymmetries

Real estate agents exploit asymmetric information conditions in urban property markets to fragment transactions and generate speculative opportunities. The lack of comprehensive property price databases and rental market information enables intermediaries to maintain artificial pricing structures that accommodate black money flows. nipfp

Technological and Enforcement Innovations

Data-Driven Investigation Approaches

Indian authorities increasingly employ data analytics for benami property detection, using registry data coordination across multiple cities. The Delhi BPU’s successful investigation of a retired civil servant case, resulting in ₹2.4 billion asset attachments, demonstrates the effectiveness of coordinated data-driven approaches. These methods involve cross-referencing property registrations, company filings, and financial transaction records to identify suspicious ownership patterns. adb

Digital Transaction Monitoring

Enhanced digital monitoring systems track electronic fund transfers and banking relationships to identify layered transactions characteristic of money laundering schemes. Financial intelligence units coordinate with international agencies to monitor cross-border flows and identify politically exposed persons (PEPs) involved in suspicious real estate transactions. enforcementdirectorate+1

Economic and Social Implications

Housing Affordability Crisis

Black money circulation in real estate generates artificial price inflation that denies affordable housing access to the majority of the population. The concentration of illicit funds on high-income segment properties creates market distortions that prevent middle and lower-income families from accessing homeownership opportunities. This wealth concentration effect perpetuates social inequalities and undermines inclusive economic development objectives. nipfp

Revenue Loss Assessment

Government revenue losses from real estate tax evasion represent significant fiscal impacts across multiple tax categories. Income tax, capital gains tax, stamp duties, and property taxes suffer substantial erosion through systematic underreporting and cash transaction mechanisms. The NIPFP study indicates that combined tax burden reduction could potentially increase compliance rates if properly implemented. nipfp

Economic Formalization Challenges

The persistence of informal transaction mechanisms impedes India’s economic formalization objectives and financial system transparency goals. Cash-based property dealings maintain parallel economic structures that resist integration with formal banking and credit systems, limiting access to institutional financing for legitimate market participants. grantthornton+1

Future Challenges and Reform Directions

Regulatory Coordination Requirements

Effective money laundering prevention requires enhanced coordination between registration authorities, tax departments, and enforcement agencies. Current institutional fragmentation enables regulatory arbitrage opportunities that sophisticated operators exploit through jurisdictional shopping and procedural delays. nipfp

Technology Integration Needs

Blockchain and artificial intelligence technologies offer potential solutions for transaction transparency and ownership verification. Digital property registries linked to financial intelligence systems could eliminate many current opportunities for beneficial ownership concealment and transaction manipulation. adb

International Cooperation Imperatives

Cross-border money laundering increasingly requires enhanced international cooperation mechanisms for asset recovery and beneficial ownership identification. India’s participation in global financial intelligence networks remains crucial for addressing sophisticated transnational money laundering schemes. enforcementdirectorate

Conclusion

The conversion of black money through land transactions in India represents a persistent and evolving challenge that requires comprehensive policy responses across multiple regulatory domains. While recent reforms including RERA implementation, enhanced financial monitoring, and aggressive enforcement actions have created significant compliance pressures, sophisticated operators continue adapting through technological innovations and regulatory arbitrage opportunities.

The quantitative evidence demonstrates that real estate money laundering operates at massive scales, with metropolitan markets facilitating thousands of crores in illicit fund conversion annually. Traditional methods such as under-valuation and agricultural land flipping coexist with modern techniques involving shell companies, circular trading, and split transaction strategies that exploit regulatory gaps and enforcement limitations.

Successful policy responses must address structural market failures including oligopolistic concentration, valuation inconsistencies, and information asymmetries that create conditions enabling money laundering activities. Technological solutions including data analytics, digital registries, and enhanced financial intelligence capabilities offer promising avenues for detection and prevention improvements.

However, ultimate success requires sustained political commitment to institutional coordination, regulatory harmonization, and enforcement resource allocation. The economic and social costs of continued black money circulation through real estate markets—including housing affordability crises, revenue losses, and economic informalization—justify comprehensive reform efforts despite their implementation complexities.

The ongoing evolution of money laundering techniques demands adaptive regulatory responses that anticipate emerging threats while maintaining legitimate market functionality. India’s experience offers valuable lessons for other developing economies confronting similar challenges in real estate sector formalization and financial system integrity protection.

- https://www.businesstoday.in/personal-finance/tax/story/black-money-to-white-tax-tribunal-torches-farmland-scam-thats-cleaned-crores-for-decades-482369-2025-06-30

- https://www.caalley.com/news-updates/indian-news/flipping-farm-land-for-cash-itat-s-ruling-may-close-india-s-oldest-black-money-trick

- https://nipfp.org.in/media/documents/BLACK_MONEY__IN_THE_REAL_ESTATE_SECTOR_A_STUDY_4PHVJBR.pdf

- https://economictimes.com/news/economy/policy/flipping-farm-land-for-cash-itats-ruling-may-close-indias-oldest-black-money-trick/articleshow/122146748.cms

- https://aktassociates.com/blog/the-biggest-mistake-nris-make-in-selling-property-in-india-dealing-with-black-money/

- https://www.indiatoday.in/india/story/prime-minister-narendra-modi-black-money-shell-companies-1029870-2017-08-16

- https://www.grantthornton.in/insights/blogs/the-making-and-breaking-of-shell-companies/

- https://economictimes.com/news/company/corporate-trends/how-shell-companies-turn-black-money-of-india-inc-politicians-into-white-and-vice-versa/articleshow/20947474.cms

- https://www.reporters-collective.in/trc/baba-ramdevs-real-estate

- https://precisa.in/everything-about-circular-transactions/

- https://en.wikipedia.org/wiki/Circular_trading

- https://www.investopedia.com/terms/c/circulartrading.asp

- https://rbi.org.in/Commonman/English/Scripts/Notification.aspx?Id=530

- https://www.businesstoday.in/personal-finance/real-estate/story/trying-to-buy-a-property-using-white-money-black-demand-leaves-techie-stuck-472336-2025-04-17

- https://www.pib.gov.in/newsite/printrelease.aspx?relid=153785

- https://timesofindia.indiatimes.com/india/proceeds-of-crime-in-vadra-land-deal-used-to-acquire-property-ed-tells-court/articleshow/122891853.cms

- https://www.ndtv.com/india-news/robert-vadra-allegedly-earned-rs-58-crore-illegally-bought-land-at-half-of-market-price-ndtv-accesses-chargesheet-9056730

- https://enforcementdirectorate.gov.in/sites/default/files/latestnews/Press%20Release%20-%20Arrests%20in%20Jayesh%20Mehta%20Case%20(VVMC%20Scam)%20-%2015.08.2025%201.pdf

- https://www.indiatoday.in/india/story/enforcement-directorate-noida-property-scam-ufhl-2740795-2025-06-14

- https://enforcementdirectorate.gov.in/sites/default/files/latestnews/Press%20Release-PAO-%20Bhasin%20Infotech%20and%20Infrastructure-18.6.2025.pdf

- https://enforcementdirectorate.gov.in/sites/default/files/Act&rules/THE%20PREVENTION%20OF%20MONEY%20LAUNDERING%20ACT,%202002.pdf

- https://fiuindia.gov.in/files/AML_Legislation/pmla_2002.html

- https://enforcementdirectorate.gov.in

- https://www.ncib.in/pdf/money-laundering-act.pdf

- https://dea.gov.in/sites/default/files/moneylaunderingact.pdf

- https://tuljalegal.in/blog/real-estate-laws-in-curbing-black-money-in-india

- https://highcourtchd.gov.in/landmark_judgments/HC/English/RFA_472_1978.pdf

- https://visionias.in/current-affairs/news-today/2024-10-19/polity-and-governance/supreme-court-to-review-2022-judgment-on-prohibition-of-benami-property-transactions-act-pbpta-1988

- https://www.adb.org/publications/the-hunt-for-benami-property-a-data-driven-approach-to-financial-investigation

- https://sansad.in/getFile/annex/256/AU3751.pdf

- https://www.bajajfinserv.in/insights/know-all-about-rera-act

- https://www.ahlawatassociates.com/blog/mandatory-compliance-by-real-estate-agents-under-pmla

- https://rera.punjab.gov.in/rera/rwPDF/Circulars/2023/20230720CPN7d07442e-8e41-48b7-9dfa-3fdbbef32cf4.pdf

- https://rera.telangana.gov.in/Home/ShowPdf?pdffilename=BU_010824133253066.pdf

- https://www.bricksnwall.com/blog/demonetisation-short-term-and-long-term-impact-on-the-property-market

- https://caravanmagazine.in/vantage/r-nagaraj-real-estate-demonetisation

- https://tallysolutions.com/gst/gst-impact-on-real-estate-overall/

- https://www.business-standard.com/article/economy-policy/explained-why-no-input-tax-may-widen-scope-of-black-money-in-real-estate-119030400309_1.html

- https://www.linkedin.com/pulse/impact-gst-indian-real-estate-sector-avneesh-sood

- https://gstcouncil.gov.in/sites/default/files/2024-04/realestate_ghazii.pdf

- https://fiuindia.gov.in/files/FAQs/faqs.html

- https://www.voiceofca.in/siteadmin/document/Financeminstudieshighuseofblackmoneyinrealestatesector.pdf

- https://indiaforensic.com/certifications/video-learning/laundering-real-estate/

- https://dea.gov.in/sites/default/files/WhitePaper_BackMoney2012_0.pdf

- https://timesofindia.indiatimes.com/business/india-business/black-money-component-in-property-transactions-has-reduced/articleshow/89835817.cms

- https://www.kychub.com/blog/money-laundering-in-real-estate/

- https://www.linkedin.com/posts/akshatshrivastavainsead_indias-real-estate-is-built-on-black-money-activity-7192355821576474624-8Su6

- https://www.reddit.com/r/IndiaTax/comments/1kvso94/why_money_laundering_using_real_estate_in_india/

- https://www.nitinbhatia.in/property-deal-cash-payment-black-money/

- https://www.deccanherald.com/opinion/the-tricks-of-trade-based-money-laundering-1196015.html

- https://www.sebi.gov.in/sebi_data/docfiles/9081_t.html

- https://indiacode.nic.in/handle/123456789/2036?view_type=search

- https://www.casemine.com/search/in/benami+property

- https://enforcementdirectorate.gov.in/press-release

- https://www.gstinindia.in/TOI%E2%80%99s_take_on_GST_to_Fight_with_Black_Money_in_Real_Estate_and_Alcohol_Market.aspx

- http://www.ijstm.com/images/short_pdf/1496989268_ID1042ijstm.pdf