“Risk prima fade passes with the property”. Explain this statement.

The principle “Risk prima facie passes with property,” as outlined in Section 26 of the Sale of Goods Act, establishes a fundamental rule for determining who bears the loss or damage to goods after a sale agreement. Essentially, unless explicitly agreed otherwise, the risk associated with the goods shifts from the seller to the buyer at the same time as the ownership (property) in those goods is transferred. This means that once the buyer becomes the owner, they also become responsible for any loss or damage, regardless of whether the goods have been physically delivered.

The General Rule: Risk and Property Go Hand-in-Hand

Section 26 clearly states: “Unless otherwise agreed, the goods remain at the seller’s risk until the property therein is transferred to the buyer, but when the property therein is transferred to the buyer, the goods are at the buyer’s risk whether delivery has been made or not.”1

This provision establishes a direct link between ownership and risk. The law presumes that the party who owns the goods has the primary interest in their safety and well-being and should therefore bear the consequences of any loss or damage. The passing of risk is generally simultaneous with the passing of property.

Illustration:

A bids ₹1,000 for a painting at an auction.

- Scenario 1: Damage before the hammer falls. If the painting is accidentally damaged before the auctioneer’s hammer falls (signifying the completion of the sale and transfer of property), the loss is borne by the seller (the auction house or the original owner).

- Scenario 2: Damage after the hammer falls. If the painting is damaged after the hammer falls, the loss is borne by A, the buyer, even if they haven’t yet taken physical possession of the painting.

Case Law Example:

In Shashi Mohun v. Nobo Kristo (1978), the defendant purchased a large quantity of rice and paid an earnest amount, taking partial delivery. Before the remaining rice could be delivered, it was destroyed by fire. The Calcutta High Court held that the buyer was liable for the loss of the undelivered rice because the property in the whole quantity of rice had not yet passed to the buyer. Consequently, the seller was entitled to recover the remaining balance of the price from the buyer.

The “Prima Facie” Nature of the Rule: Room for Agreement

It’s crucial to understand that the rule “risk prima facie passes with property” is not absolute. The term “prima facie” indicates that this is the default position, applicable “on the face of it,” but it can be overridden by a specific agreement between the buyer and the seller.

Section 26 explicitly begins with the words “Unless otherwise agreed,” highlighting the freedom of contract. Parties can mutually decide that the risk will pass at a different time than the transfer of property. For instance, they might agree that the risk remains with the seller until the goods are physically delivered to the buyer’s premises, even if ownership has already been transferred. Conversely, they could agree that the risk passes to the buyer upon the signing of the contract, even before ownership is formally transferred.

The law does not mandate that risk can only pass after the property has passed. The inference of such an alternative arrangement must, however, be clear from the express or implied agreement, or the established usage of a particular trade.

Exceptions to the General Rule: When Risk Doesn’t Follow Property

While the general principle links risk to ownership, several exceptions exist under the Sale of Goods Act:

- Agreement to the Contrary: As emphasized earlier, the parties have the autonomy to deviate from the general rule through an express or implied agreement. They can specify a different point in time for the passing of risk, independent of when the property in the goods is transferred.

- Example: In Rutter v. Palmer (1922), the contract stipulated that the risk of damage during transit would be borne by the seller, even though the property in the goods might have passed to the buyer upon shipment.

- Seller’s Agreement to Deliver at Their Own Risk: When the seller agrees to deliver the goods at their own risk to a location different from where they were when sold, the buyer still bears the risk of deterioration necessarily incidental to the course of transit. This exception, however, is also subject to any contrary agreement between the parties. The seller bears the risk of accidental loss during transit, but not normal wear and tear.

- Delay in Delivery Due to the Fault of Either Party: If the delivery of the goods is delayed due to the fault of either the buyer or the seller, the goods are at the risk of the party responsible for the delay concerning any loss that might not have occurred but for such fault.

- Example: In Demby Hamilton & Co. Ltd. v. Barden (1949), the buyer delayed taking delivery of apple juice, and the juice subsequently deteriorated. The court held that the loss due to deterioration was at the buyer’s risk because the delay was their fault.

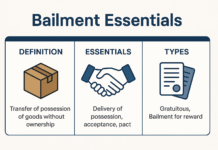

- Duties and Liabilities as Bailee: The general principle that risk passes with property does not affect the duties and liabilities of either the seller or the buyer as a bailee of the goods of the other party. A bailee is someone who holds possession of goods belonging to another for a specific purpose. Even if the risk has passed, the party in possession might still have a duty of care towards the goods as a bailee.

- Example: If the seller retains possession of the goods after the property has passed to the buyer, they might be considered a bailee for the buyer. In this role, they would be responsible for taking reasonable care of the goods, even though the risk of accidental loss might lie with the buyer. Similarly, if the buyer takes delivery but the property hasn’t fully passed, they might be a bailee for the seller in certain aspects.

Conclusion: The Importance of Clearly Defining Risk

While the principle “risk prima facie passes with property” provides a useful default rule, the Sale of Goods Act recognizes the need for flexibility. Parties to a sale contract have the freedom to allocate the risk of loss or damage independently of the transfer of ownership.

Therefore, it is always prudent for buyers and sellers to clearly define in their agreement when the risk associated with the goods will pass. This can prevent potential disputes and ensure clarity regarding who will bear the financial burden of any unforeseen loss or damage to the goods during the transaction process. Understanding both the general rule and its exceptions is crucial for navigating the legal framework governing the sale of goods and protecting one’s interests.